What Is Expense Ratio and How It May Impact Your Portfolio

- Feb 9

- 3 min read

Understanding the Expense Ratio

An expense ratio represents the annual operating cost of a mutual fund or exchange-traded fund (ETF). It is expressed as a percentage of the fund’s total assets and reflects the cost of managing and operating the investment.

Rather than being billed directly to investors, the expense ratio is typically deducted from the fund’s assets on an ongoing basis. As a result, it is reflected indirectly in the fund’s performance and net asset value (NAV). Understanding this concept is an important part of evaluating investment costs and long-term portfolio efficiency.

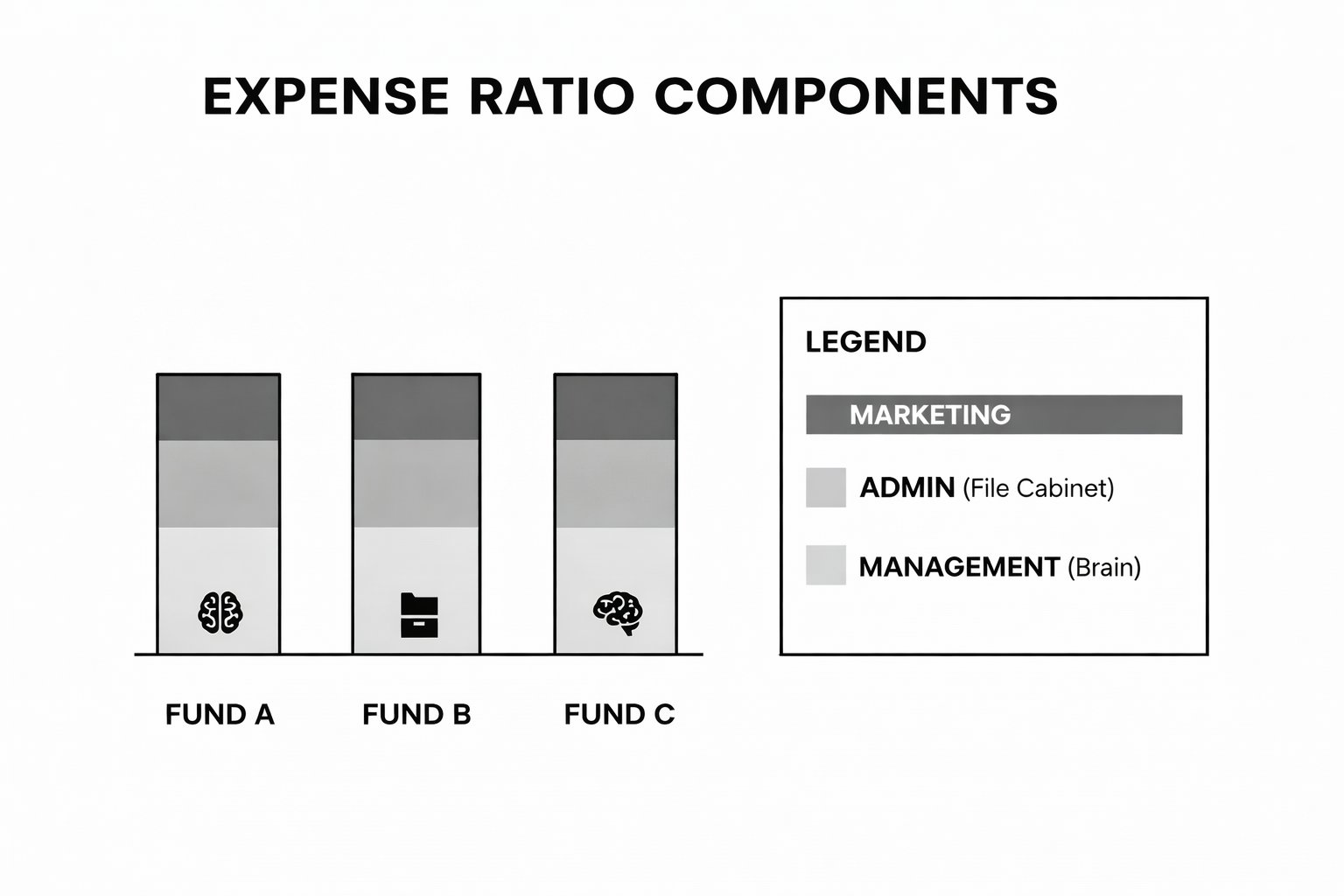

What an Expense Ratio Includes

The expense ratio bundles several operational costs into a single figure. While the specific components vary by fund, common elements include:

Management fees: Compensation for portfolio managers and research teams

Administrative expenses: Accounting, legal, recordkeeping, and reporting costs

Marketing and distribution fees (12b-1 fees): Costs related to advertising and distribution, when applicable

Other operating expenses: Custody, compliance, and fund administration

These costs are necessary to operate the fund but reduce the portion of returns that ultimately accrue to investors.

How Expense Ratios Are Applied

Expense ratios are typically deducted daily from fund assets. Because of this structure, investors do not see a separate line-item charge on account statements. Instead, the fee reduces the fund’s total return over time.

Even relatively small percentage differences may influence long-term outcomes, particularly for investors with longer time horizons.

The Concept of Fee Drag

Fee drag refers to the cumulative effect that ongoing investment expenses may have on portfolio growth. Since expense ratios reduce the amount of capital that remains invested, they can also reduce the amount available to compound over time.

While a difference of a few tenths of a percent may appear minimal in a single year, the impact can become more noticeable over decades due to compounding.

Expense Ratios and Compounding

Compounding works on net returns, not gross returns. This means that expenses are deducted before gains can compound. Over long periods, higher expense ratios may materially reduce the ending value of a portfolio compared to similar investments with lower costs.

This does not imply that lower-cost funds are always preferable, but it highlights the importance of evaluating costs in context.

Comparing Expense Ratios Across Investment Types

Expense ratios often vary based on investment strategy and structure.

Actively managed funds: Typically have higher expense ratios due to research, trading activity, and management oversight

Passively managed funds (index funds): Generally have lower expense ratios because they track a benchmark rather than rely on active security selection

ETFs: Often have lower operating costs, though this varies by strategy and asset class

Comparing funds within the same category may provide more meaningful insights than comparing across different strategies.

What Expense Ratios Do Not Include

Certain costs are not reflected in a fund’s expense ratio, including:

Brokerage commissions from trading within the fund

Sales loads or transaction fees charged by brokers

Account-level fees charged by custodians or platforms

Understanding the full cost structure of an investment involves reviewing more than just the expense ratio.

Evaluating Expense Ratios in Context

An expense ratio should be evaluated alongside other factors, such as:

Investment strategy and objectives

Risk profile and asset class exposure

Historical performance relative to benchmarks (net of fees)

Role of the investment within a broader portfolio

Cost is an important variable, but it is one component of a comprehensive investment evaluation process.

Conclusion

An expense ratio represents the ongoing cost of owning a fund and directly affects net investment returns. While the impact may not be immediately visible, these costs can influence long-term outcomes through compounding.

Understanding how expense ratios work and how they fit within an overall investment strategy can help investors make more informed, cost-aware decisions aligned with long-term financial goals.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investing involves risk, including possible loss of principal. The information presented is for educational purposes only and should not be interpreted as individualized investment, tax, or legal advice. Past performance is not indicative of future results. For more information, please review our Form ADV, available upon request.

Comments