Understanding Inherited IRA Distribution Rules

- Jan 27

- 3 min read

Overview of Inherited IRA Distribution Rules

Inherited IRA distribution rules play an important role in estate, tax, and retirement planning. These rules determine how and when beneficiaries must withdraw funds from inherited retirement accounts and can significantly influence long-term tax outcomes.

Recent legislative changes have altered how inherited IRAs are treated, making it essential for beneficiaries to understand the framework that applies to their situation. This overview is intended for general educational purposes and should be evaluated in light of individual circumstances.

The SECURE Act and the 10-Year Rule

The SECURE Act, enacted in 2019, introduced significant changes to inherited IRA distribution requirements. For many non-spouse beneficiaries, the law replaced lifetime “stretch” distributions with a 10-year depletion rule.

Under this rule, the inherited IRA must generally be fully distributed by December 31 of the tenth year following the original account owner’s death. While annual withdrawals may not be required in every year, the account balance must be reduced to zero by the end of the 10-year period.

Required Minimum Distributions (RMDs)

Whether annual RMDs are required during the 10-year period depends on whether the original account owner had begun taking RMDs prior to death.

Key Considerations

If the original owner had started RMDs, beneficiaries may be required to take annual distributions

Missing required distributions may result in excise taxes

Distribution timing can influence taxable income in each year

Understanding these requirements helps beneficiaries avoid penalties and plan withdrawals more effectively.

Beneficiary Categories and Special Rules

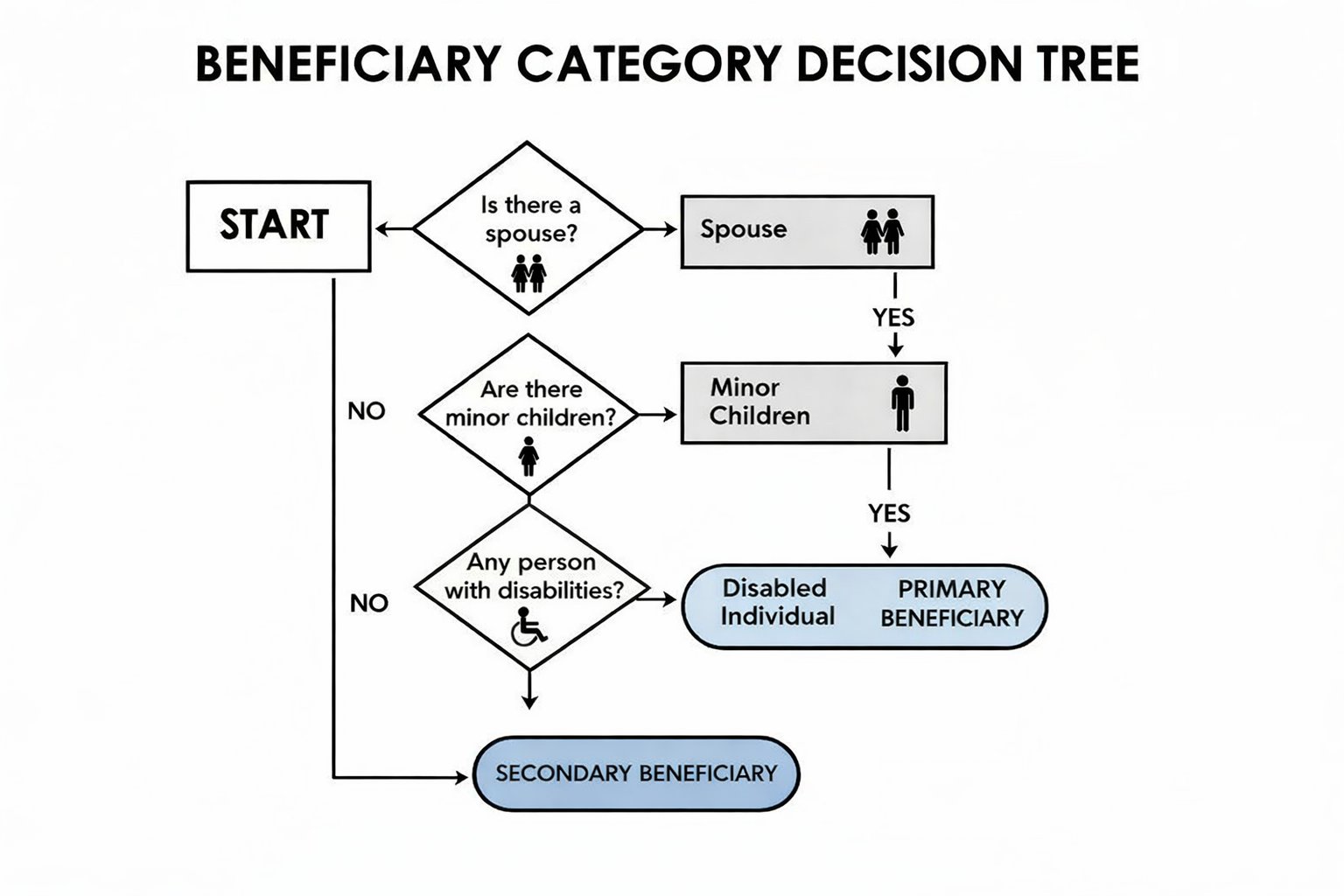

Distribution rules vary depending on the type of beneficiary.

Eligible Designated Beneficiaries

Certain beneficiaries may qualify for life-expectancy-based distributions rather than the 10-year rule. These may include:

Surviving spouses

Minor children of the original account owner

Individuals with qualifying disabilities or chronic illnesses

Beneficiaries not more than 10 years younger than the original owner

Once a minor child reaches the age of majority, the 10-year rule typically applies.

Non-Eligible Designated Beneficiaries

Most non-spouse beneficiaries fall into this category and are generally subject to the 10-year depletion rule without life-expectancy-based withdrawals.

Spousal Beneficiary Options

Surviving spouses often have greater flexibility when inheriting an IRA.

Common options may include:

Treating the inherited IRA as their own

Rolling assets into an existing IRA

Maintaining the account as an inherited IRA

The appropriate choice may depend on age, income needs, and broader retirement planning considerations.

Trusts and Inherited IRAs

When a trust is named as beneficiary, distribution rules depend on how the trust is structured.

Key Factors

Whether the trust qualifies as a “see-through” trust

Identification of trust beneficiaries

Required distribution timelines

Improper trust design may accelerate distributions, highlighting the importance of coordinated estate planning.

Tax Considerations For Beneficiaries

Withdrawals from inherited traditional IRAs are generally taxed as ordinary income. Roth inherited IRAs may allow for tax-free distributions, provided applicable requirements are met.

Tax considerations often include:

Current and projected income levels

Interaction with other taxable events

Impact on Medicare premiums or income-based thresholds

Distribution timing may influence overall tax exposure during the inherited IRA period.

Common Pitfalls to Avoid

Beneficiaries navigating inherited IRA rules may encounter challenges such as:

Missing required distribution deadlines

Misunderstanding beneficiary classification

Relying on outdated pre-SECURE Act rules

Concentrating withdrawals in a single high-income year

Awareness of these issues may help reduce unintended consequences.

Integrating Inherited IRAs Into Broader Planning

Inherited IRA decisions often intersect with:

Retirement income planning

Estate and legacy planning

Charitable strategies

Long-term cash-flow needs

Coordination across planning disciplines may support better alignment with long-term financial goals.

Conclusion

Inherited IRA distribution rules are complex and continue to evolve. Understanding beneficiary categories, distribution timelines, and tax considerations is an important step in managing inherited retirement assets thoughtfully.

Because these rules can have long-term financial implications, professional guidance is often an important part of evaluating inherited IRA strategies.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investing involves risk, including possible loss of principal. The information presented is for educational purposes only and should not be interpreted as individualized investment, tax, or legal advice. Past performance is not indicative of future results. For more information, please review our Form ADV, available upon request.

Comments