Navigating Central Ohio's Evolving Business and Real Estate Landscape

- Nov 13, 2025

- 4 min read

After a period of rapid growth, Central Ohio’s economy is entering a new, more sustainable phase—offering both challenges and opportunities for investors and business owners.

Foundational Strengths of the Central Ohio Market

Central Ohio’s economic stability is built on several key strengths that support both residential and commercial sectors. Understanding these foundations can help investors and business owners position themselves effectively in the region’s next growth chapter.

Diversified Economic Base

The region’s balance across technology, logistics, healthcare, finance, and advanced manufacturing may help buffer it against market fluctuations and provides a broad employment foundation.

Major Corporate Investments

Recent commitments from Intel, Honda, and Google are transforming the regional economy. These projects not only generate thousands of high-skilled jobs but also boost surrounding industries and housing demand.

Source: Ideastream, https://www.ideastream.org/2023-05-03/google-to-build-two-new-data-centers-in-ohio-in-addition-to-an-existing-one-in-columbus

Consistent Population Growth

The Columbus area continues to attract professionals and families from across the U.S. This sustained influx supports long-term demand for housing, retail, and business services.

This combination of diversification, investment, and population growth positions Central Ohio as one of the Midwest’s most resilient regional economies.

Sources: Axios Columbus, https://www.axios.com/local/columbus/2025/01/15/central-ohio-leads-statewide-population-growth ; JobsOhio, https://www.jobsohio.com/blog/ohios-economy-resilient-positioned-for-growth

Residential Real Estate: A Market Moving Toward Balance

After years of record growth, Central Ohio’s housing market is normalizing. The pace is slowing—but not stalling—signaling a healthier long-term environment for both buyers and investors.

Source: The Columbus Team, https://thecolumbusteam.com/central-ohio-housing-report/#:~:text=The%20Central%20Ohio%20Housing%20Report%20for%20September,of%20their%20original%20list%20price%20and%20the

Key trends include:

Increased Housing Inventory: Listings have risen roughly 25% year-over-year, offering more options for buyers and stabilizing prices.

Moderating Price Growth: Median sales prices reached $338,000 (up 4.8% year-over-year), reflecting steadier appreciation.

Buyer Adaptation: Higher mortgage rates have tempered demand but also encouraged more intentional, long-term purchasing decisions.

Sources: WSYX, https://abc6onyourside.com/news/local/central-ohio-home-sales-september-2025-columbus-realtors-market-report-real-estate-housing-inventory-prices-franklin-licking-union-county-mls-buyers-sellers-negotiation-homes-condominiums-trends-data-analysis ; Barron’s, https://www.barrons.com/articles/home-afford-metro-where-to-look-toledo-62d8e8f3?gaaat=eafs&gaan=AWEtsqdF2OzAlbUJ7LCVaJVNDhVTnGQiNcRbTQUA27BsCeCuCnWLN5zD3GuihWbtx6w%3D&gaats=6914d4a1&gaasig=w4sIo0aBue7qMo-YzEyDF5ihbghHTf-0tcjr4Zge7UiRsezoMyj6utq24b47ctRZog6q7ZwfUq8r9IcTN1HEw%3D%3D

This phase may benefit disciplined investors seeking stability over speculation. A balanced market allows for more thoughtful investment and long-term portfolio planning.

Key Drivers of Central Ohio’s Economic Growth

Central Ohio’s economic story is powered by an intersection of corporate investment and demographic momentum, creating a self-reinforcing cycle of expansion.

Corporate Investment Impact

Large-scale investments from Intel, Google, and Honda create local ecosystems of smaller suppliers, construction firms, and service providers. These ripple effects stimulate local employment and infrastructure improvements.

Demographic and Workforce Trends

The region continues to attract a skilled and growing workforce, including graduates from The Ohio State University and transplants from higher-cost states. This ongoing migration supports sustained real estate and business demand.

Source: Site Selection, https://siteselection.com/how-the-columbus-region-became-the-talent-factory-of-the-midwest/

Market Data Reflection

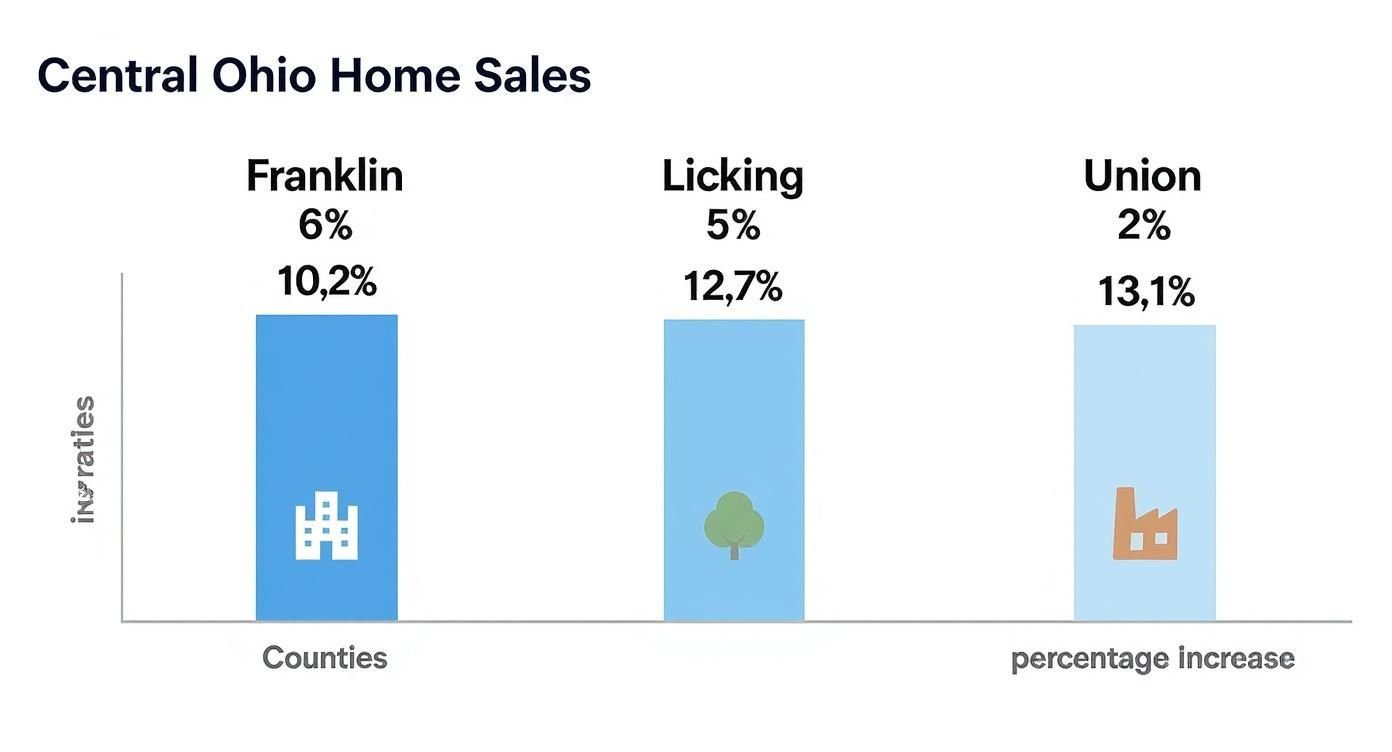

Recent data show home sales rising 7.9% year-over-year, with standout growth in Licking (18.4%) and Union (19%) counties—both areas tied to industrial expansion.

These fundamentals suggest that Central Ohio’s growth is demand-driven, not speculative—an encouraging signal for long-term investors.

Commercial Real Estate: An Adaptive Market

Central Ohio’s commercial real estate market reflects shifting post-pandemic behaviors while maintaining strong fundamentals across industrial, office, and retail sectors.

Office Sector Transformation

Hybrid work has led to a “flight to quality.” Companies are downsizing but upgrading—favoring collaborative, modern spaces. Premium Class-A buildings with amenities continue to perform, while outdated spaces face increased vacancy pressure.

Source: Colliers, https://www.colliers.com/en/research/columbus/2025-q2-office-trends-colliers-columbus#:~:text=At%20the%20halfway%20point%20of,for%20slow%20but%20steady%20improvements.

Industrial Sector Strength

With e-commerce and logistics growth, industrial vacancy rates remain near historic lows (~4.4%). This sector benefits from Columbus’s central location and access to major population centers.

Source: Colliers, https://www.colliers.com/en/news/columbus/large-scale-commitments-drive-down-q3-vacancy-rate-in-central-ohio-industrial-market

Retail Reinvention

Retail is shifting toward mixed-use, experience-driven spaces that blend shopping, dining, and entertainment. These hubs create community engagement and strengthen local commercial ecosystems.

Each sector offers distinct risks and opportunities, requiring an adaptive strategy that reflects both macroeconomic conditions and local market realities.

Integrating Market Insights into a Wealth Strategy

Connecting Central Ohio’s economic and real estate trends to personal or business financial planning is critical. As the region moves from rapid acceleration to measured growth, investors should assess portfolio alignment and future positioning.

Portfolio Alignment

Re-evaluate real estate allocations—balancing direct ownership with vehicles like REITs to manage liquidity, control, and tax exposure.

Strategic Planning for Business Owners

A strong regional economy offers expansion opportunities, but slower growth rewards careful cost management. Evaluate whether leasing or owning commercial space aligns best with your long-term business goals.

Real Estate in Estate Planning

Real estate often represents a substantial portion of wealth. Strategies such as trusts, LLC ownership, or succession plans can help preserve value and simplify future transfers.

This market normalization phase may be a suitable time to ensure wealth and estate strategies reflect both local conditions and long-term objectives.

Conclusion: A Measured Phase for Growth

Central Ohio’s evolution into a balanced, mature economy marks a new era. The region’s resilience—driven by corporate investment, workforce expansion, and housing stability—creates a favorable environment for investors and families who prioritize disciplined, long-term strategies.

By connecting business performance, real estate data, and wealth management, investors can better navigate this phase with confidence and clarity.

Disclosure

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities.

This article is for informational purposes only and is not intended as investment, legal, or tax advice. Please consult with your professional advisors before taking any action. Past performance is not a guarantee of future results.

Comments