Legacy Planning and Wealth Transfer Explained

- Oct 9, 2025

- 3 min read

When we discuss legacy planning and wealth transfer, the conversation extends beyond finances. It involves the thoughtful process of striving to secure your family’s future and ensuring your values may endure for generations. Think of it as a roadmap for your assets, guiding them to support the people and causes that matter to you.

Why Legacy Planning Matters Now

Without a clear plan, a lifetime of work may be impacted by taxes, legal disputes, or inefficient management. A well-structured strategy can help protect wealth and transfer it according to your intentions. This process is personal, extending beyond numbers into values and priorities.

Implementation checkpoints:

Provide for heirs: Support loved ones in a way that encourages responsibility.

Mitigate tax burdens: Use legal strategies that may reduce estate, gift, and transfer taxes.

Support philanthropy: Direct funds to meaningful causes.

Preserve family harmony: Establish clear, transparent instructions.

The Global Shift in Wealth Transfer

Legacy planning is no longer purely domestic. Families are increasingly mobile, with assets and heirs crossing borders. This introduces complexities with multiple legal systems, tax rules, and inheritance laws.

High-net-worth migration: In 2025, projections suggested around 142,000 millionaires may relocate globally, with further increases expected. Motivations include political stability, favorable tax regimes, and family lifestyle.

Implementation checkpoints:

Review estate plans against laws in every jurisdiction where family or assets are located.

Explore cross-border trust structures.

Understand tax treaties affecting estate and inheritance taxes.

Source: Henley Private Wealth Migration Report 2025, https://www.henleyglobal.com/publications/henley-private-wealth-migration-report-2025/great-wealth-flight-millionaires-relocate-record-numbers#:~:text=A%20historic%20wave%20of%20wealth,accelerating%20global%20race%20for%20wealth.

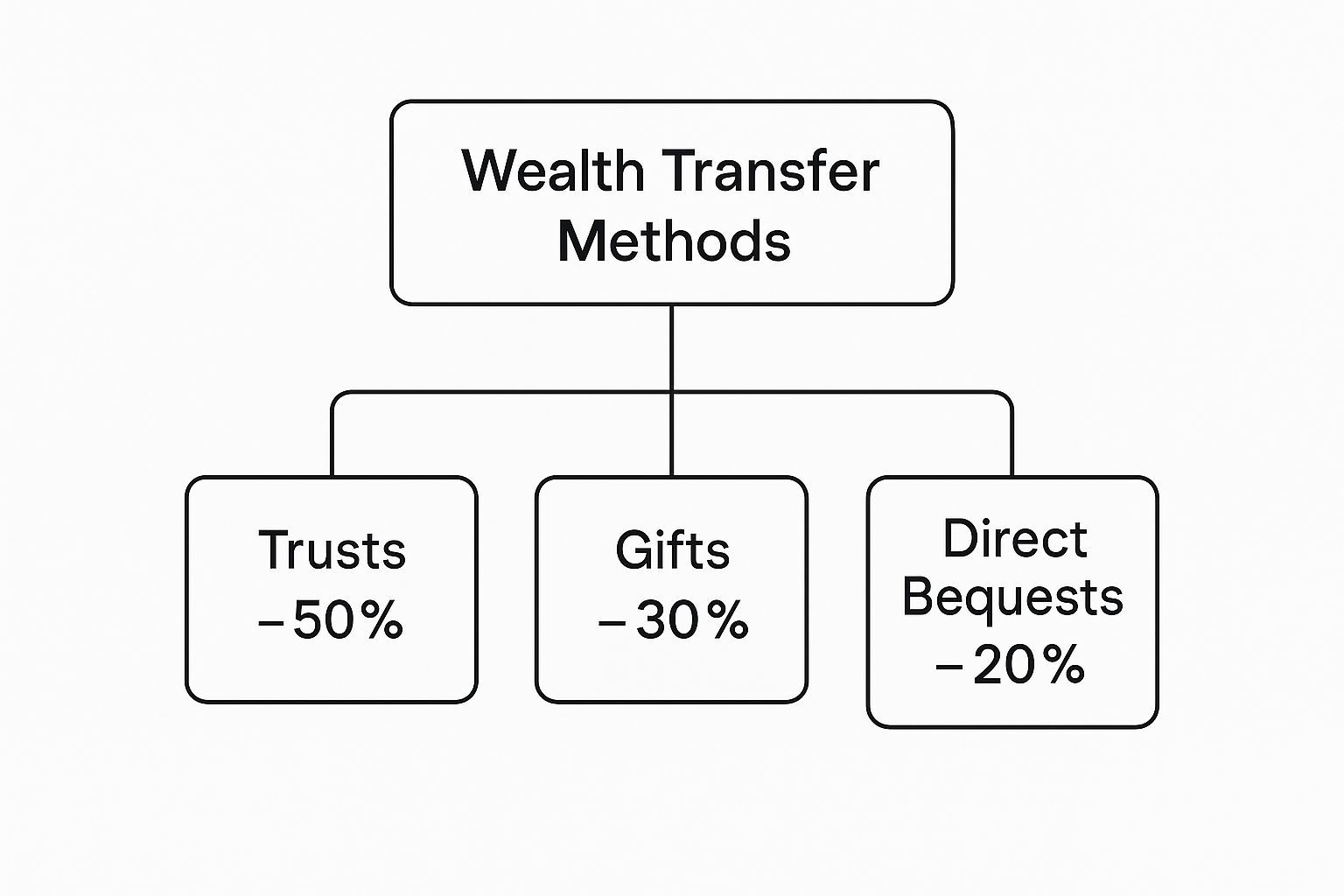

Core Strategies for Transferring Wealth

Wills

A Will establishes how assets are divided and who will act as executor. It typically requires probate, a public process after death.

Trusts

A Trust is a private structure to manage assets during life and after death.

Revocable Living Trusts: Can be amended or revoked during life; often used to avoid probate.

Irrevocable Trusts: Once established, generally cannot be changed; may help reduce estate taxes and protect assets.

Strategic Gifting

Gifting can reduce taxable estate size while supporting heirs during your lifetime.

For 2024, the IRS annual gift exclusion was $18,000 per person ($36,000 for married couples).

Over time, annual gifting can represent an efficient transfer of wealth.

Source: Internal Revenue Service, https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

Tax and Legal Landscape

Federal Transfer Taxes

Estate Tax: Applies to the value of assets above the exemption.

Gift Tax: Linked to the estate tax; annual exclusion applies.

Generation-Skipping Transfer (GST) Tax: Targets transfers directly to grandchildren; has a separate exemption.

State-Level Taxes

Some states impose estate or inheritance taxes with lower thresholds than federal levels. State-specific rules should always be reviewed.

Implementation checkpoints:

Review laws in every state where you own property.

Coordinate with tax and legal professionals.

The Human Side of Wealth Transfer

Documents and taxes matter, but family governance can be equally important. Open communication, shared values, and preparedness may prevent conflict and strengthen stewardship across generations.

Family mission statement: Define values and purpose for wealth.

Family meetings: Build trust, educate younger members, and prevent misunderstandings.

Education: Teach financial literacy and family history.

A global wealth study noted that a significant amount of wealth is expected to transfer worldwide over the next two decades, reinforcing the importance of preparing heirs.

Source: UBS Global Wealth Report 2025, https://www.ubs.com/microsites/nobel-perspectives/en/latest-economic-questions/economics-society/articles/how-to-prepare-for-wealth-transfer.html

Building An Enduring Legacy

Legacy planning is not abstract — it is built on decisions you make today. The strongest plans combine legal and tax strategies with family communication, philanthropy, and education. Acting now can provide confidence, ensuring your wealth supports both your loved ones and your vision for the future.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Advisors, LLC and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Please consult with your professional advisors before taking any action. Past performance is not a guarantee of future results.

Comments