A Guide to Evidence-Based Asset Allocation Strategy

- Nov 18, 2025

- 7 min read

This material is for informational purposes only and is not intended to provide investment, tax, or legal advice. Individuals should consult their professional advisors before making any financial decisions.

An evidence-based asset allocation strategy is not about chasing market trends or attempting to predict short-term movements. Instead, it is a disciplined method for building an investment portfolio that relies on academic research and historical data rather than speculation.

The core concept is that the mix of asset classes in a portfolio—such as stocks, bonds, and real estate—may be one of the most important drivers of long-term results. The objective is to create a portfolio that aligns with an investor’s financial goals and risk tolerance.

Understanding an Evidence-Based Asset Allocation Strategy

At its heart, an evidence-based asset allocation strategy is intended to bring structure and logic to a field that can easily be influenced by emotion. Rather than reacting to headlines or attempting to forecast market swings, this approach leans on decades of financial data and rigorous analysis.

The process is similar to building a house on a solid foundation. Just as sound engineering principles guide construction, evidence-based investing relies on long-term historical performance, risk characteristics, and relationships between asset classes to inform portfolio design.

The Central Role of Asset Allocation

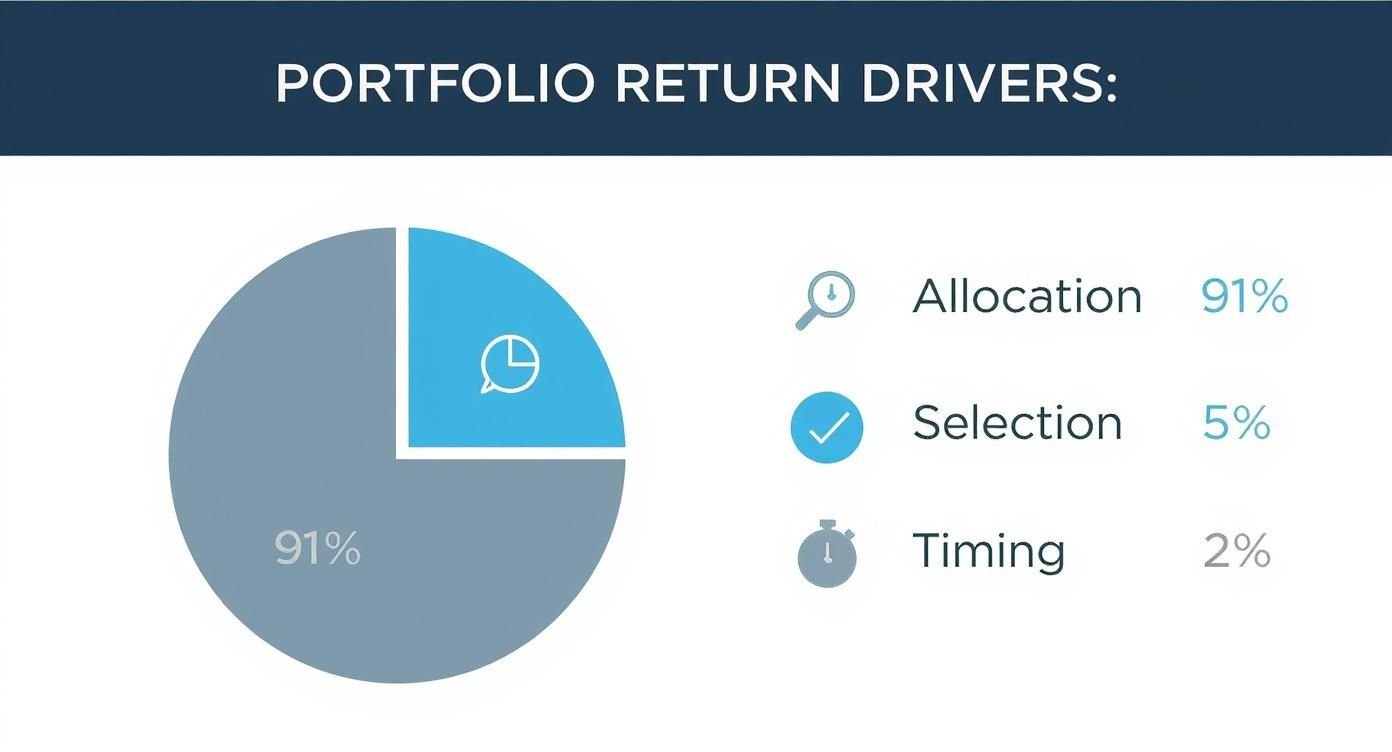

A cornerstone of this approach is the idea that how investments are divided across different categories may matter as much as, or more than, security selection. Academic research has long suggested that a portfolio’s overall asset allocation policy can explain a substantial portion of its return variability over time.

This perspective shifts the focus from trying to find a single “best” investment to building a resilient, balanced structure. The emphasis is on creating an allocation that can support long-term goals and withstand a range of market environments.

Key Principles in Practice

An evidence-based approach is guided by several core ideas that inform how a portfolio is built and managed. While the exact implementation may differ from investor to investor, the underlying philosophy is consistent.

Implementation Considerations

Data-Driven Decisions: Decisions are informed by long-term historical data on returns, volatility, and correlations between asset classes, rather than short-term predictions.

Broad Diversification: Assets are diversified across multiple sectors, countries, and regions to help manage volatility and reduce concentration risk.

Systematic Approach: Rules-based processes can help reduce the impact of behavioral biases such as fear and greed.

Long-Term Focus: The strategy is built with a multi-year or multi-decade horizon in mind, acknowledging that while short-term markets can be unpredictable, disciplined investors have historically been rewarded over time.

By adhering to these principles, an evidence-based strategy seeks to build a portfolio that supports an investor’s financial journey and risk profile.

The Core Principles of Data-Driven Investing

Data-driven investing is not about pursuing the latest popular stock or reacting to every news event. It is a philosophy built on time-tested ideas derived from market history and academic research.

Instead of focusing on short-term noise, this approach emphasizes the structural factors that have historically influenced portfolio outcomes. The intent is to instill discipline and create a process that is less reliant on emotion.

Asset Allocation as a Primary Factor

Modern financial theory suggests that asset allocation has a significant impact on portfolio behavior. While many investors focus on individual securities or market timing, research has often shown that the strategic mix of asset classes—stocks, bonds, and other investments—is a major contributor to long-term performance patterns.

Widely cited studies have indicated that a large portion of a portfolio’s return variability can be attributed to its asset allocation policy, with security selection and market timing playing comparatively smaller roles. This reinforces the idea that building a thoughtful structure may be more important than trying to identify individual “winners.”

The Power of Global Diversification

Another core principle is broad, global diversification. This involves spreading capital across a wide range of asset types and geographic regions.

A globally diversified portfolio may help reduce the impact of adverse events in any single market. Economic cycles and performance patterns differ across countries and asset classes, so owning a mix can potentially smooth the overall experience. This approach acknowledges that leadership among asset classes rotates over time and that no single region or category consistently outperforms all others.

Using Long-Term Data as a Guide

Evidence-based investing is grounded in a long-term perspective. Historical data is not used to guarantee future results, but rather to set reasonable expectations and guide portfolio construction.

By examining how different asset classes have behaved over extended periods—in terms of return, volatility, and correlation—investors and advisors can better understand potential trade-offs and build portfolios that reflect an appropriate balance between risk and reward.

Implementation Considerations

Emotional Discipline: A rules-based framework can help mitigate emotional reactions that might otherwise lead to buying high and selling low.

Realistic Goals: Historical data can inform goal setting and help investors understand the potential range of outcomes associated with different allocations.

Risk Management: Diversification across asset classes, sectors, and regions is one of the primary tools for managing risk.

Building a Diversified Evidence-Based Portfolio

Putting an evidence-based strategy into practice involves constructing a portfolio where each component serves a specific purpose, with the overall design intended to work through a variety of market conditions.

The first step is selecting the asset classes—such as U.S. equities, international equities, different types of bonds, and potentially real estate or other alternatives—that will form the building blocks of the portfolio. The goal is not to pick one “best” asset class, but to assemble a mix that works together.

Selecting Your Asset Classes

The objective is to build a combination of assets that do not all move in lockstep. For example, periods of stock market weakness have sometimes coincided with relative strength in certain types of bonds. In other environments, international stocks may offer different opportunities than domestic markets.

By studying long-term historical relationships among these asset classes, investors can create portfolios where weakness in one area may be partially offset by strength in another.

Weighting Based on Evidence

Once the asset classes are chosen, the next step is determining how much of the portfolio to allocate to each. The appropriate mix is deeply personal and should reflect financial goals, time horizon, and risk tolerance.

An evidence-based approach uses long-term data to help model how different allocation mixes have behaved historically. For example, a younger investor with decades until retirement may be comfortable with a higher allocation to growth-oriented assets. Someone approaching retirement may prefer a more balanced mix that emphasizes income and stability.

The key takeaway is that higher potential returns historically have tended to come with higher volatility. Asset allocation is about finding a combination of assets that offers an acceptable level of risk in pursuit of your goals, not eliminating volatility altogether.

Implementation Considerations

Define Your Risk Tolerance: An honest assessment of comfort with market fluctuations is essential.

Determine Your Time Horizon: Longer time frames may allow for more exposure to growth assets; shorter horizons may call for a more conservative stance.

Understand Asset Class Correlations: Choosing assets with low or modest correlations to one another can help smooth the portfolio’s overall experience.

The Role of Strategic Rebalancing

Designing an asset allocation is an important first step, but it is not a one-time exercise. Markets move continuously, and over time, portfolios can drift away from their intended allocations as some assets outperform others.

Strategic rebalancing is the process of periodically realigning the portfolio back to its target mix. This may involve trimming positions that have grown beyond their intended weight and adding to those that have lagged. Rebalancing helps maintain the desired risk profile over time.

Common Rebalancing Approaches

There is no single method that is right for every investor, but two frequently used approaches are:

Calendar-Based Rebalancing: Rebalancing on a set schedule (for example, annually or semi-annually), regardless of market conditions.

Tolerance-Band Rebalancing: Rebalancing when allocations deviate from their targets by more than a predetermined percentage (for instance, when an asset class moves 5% above or below its target weight).

Both approaches seek to bring the portfolio back in line with its original design, rather than allowing market movements to dictate the overall risk profile.

Why Rebalancing Matters

Rebalancing can help prevent any single asset class from becoming overly dominant and changing the portfolio’s risk characteristics. It also encourages a disciplined practice of taking profits from areas that have performed well and adding to areas that may be temporarily out of favor.

Implementation Considerations

Tax Awareness: In taxable accounts, realized gains may have tax implications. Rebalancing strategies should take tax impact into account.

Transaction Costs: Trading costs should be weighed against the benefits of more frequent rebalancing.

Staying the Course: The discipline to rebalance—especially during periods of market stress—can be challenging but is often integral to maintaining an evidence-based approach.

Evolving Beyond Traditional Models

Traditional portfolio frameworks, such as the classic 60% stock / 40% bond mix, have long been used as benchmarks for balanced investing. While such models have provided useful guidance, an evidence-based approach recognizes that market relationships can change over time.

There have been periods where both stocks and bonds declined simultaneously, reducing the diversification benefits that investors historically expected. These experiences reinforce the importance of regularly reviewing portfolio design, considering a broader range of asset classes where appropriate, and evaluating how different assets have behaved in both calm and stressed markets.

Implementation Considerations

Expand Horizons: Consider whether it may be appropriate to include a broader mix of asset types, such as international equities, different categories of bonds, or other diversifiers, based on your goals and risk tolerance.

Review Correlations: Periodically evaluate how asset classes are interacting—especially during volatile periods—to ensure the portfolio continues to reflect the intended diversification.

Review, Don’t React: Adjustments should be considered within the context of a long-term plan, not in response to short-term headlines.

Conclusion: Applying Evidence-Based Asset Allocation to Your Financial Journey

An evidence-based asset allocation strategy offers a structured, disciplined framework for managing investments. It shifts the focus away from trying to identify individual “winners” or time the market and toward building a diversified portfolio designed to align with your objectives, time horizon, and tolerance for risk.

The core ideas are straightforward:

Recognize asset allocation as a key driver of portfolio behavior.

Diversify broadly across asset classes and geographies.

Use long-term data and a systematic process to guide decisions.

Rebalance periodically to maintain alignment with your plan.

This approach is not about eliminating risk, which is not possible, but about managing it thoughtfully. By adhering to a process rooted in evidence and discipline, investors may be better equipped to navigate market volatility and stay focused on their long-term goals.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Investing involves risk, including possible loss of principal. The information presented is for educational purposes only and should not be interpreted as individualized investment, tax, or legal advice. Asset allocation and diversification do not guarantee a profit or protect against loss in declining markets. Past performance is not indicative of future results. For more information, please review our Form ADV, available upon request.

Comments