How to Mitigate Probate: Strategies That Seek to Protect Your Estate

- Feb 2

- 3 min read

Understanding the Probate Process

Probate is the legal process through which a deceased person’s assets are administered and distributed under court supervision. This process is designed to validate a will, settle debts, and transfer assets to beneficiaries. While probate serves an important legal function, it can involve time, administrative complexity, and public disclosure.

Estate planning strategies that address probate are often focused on improving efficiency, maintaining privacy, and supporting orderly asset transfer. This guide provides an educational overview of commonly used approaches.

Why Some Individuals Seek to Avoid Probate

Probate experiences vary by state, estate size, and asset structure. Some individuals choose to plan around probate for reasons such as:

Reducing administrative delays

Limiting court involvement

Maintaining privacy of financial affairs

Providing continuity in asset management

Simplifying the transfer process for heirs

Avoiding probate is not always necessary or appropriate, but understanding available tools helps inform planning decisions.

Revocable Living Trusts

A revocable living trust is one of the most commonly used tools for probate avoidance.

How It Works

Assets are transferred into a trust during the grantor’s lifetime. Upon death, a successor trustee manages and distributes trust assets according to the trust terms without court involvement.

Considerations

The trust must be properly funded to be effective

Assets held outside the trust may still require probate

Revocable trusts do not remove assets from the taxable estate

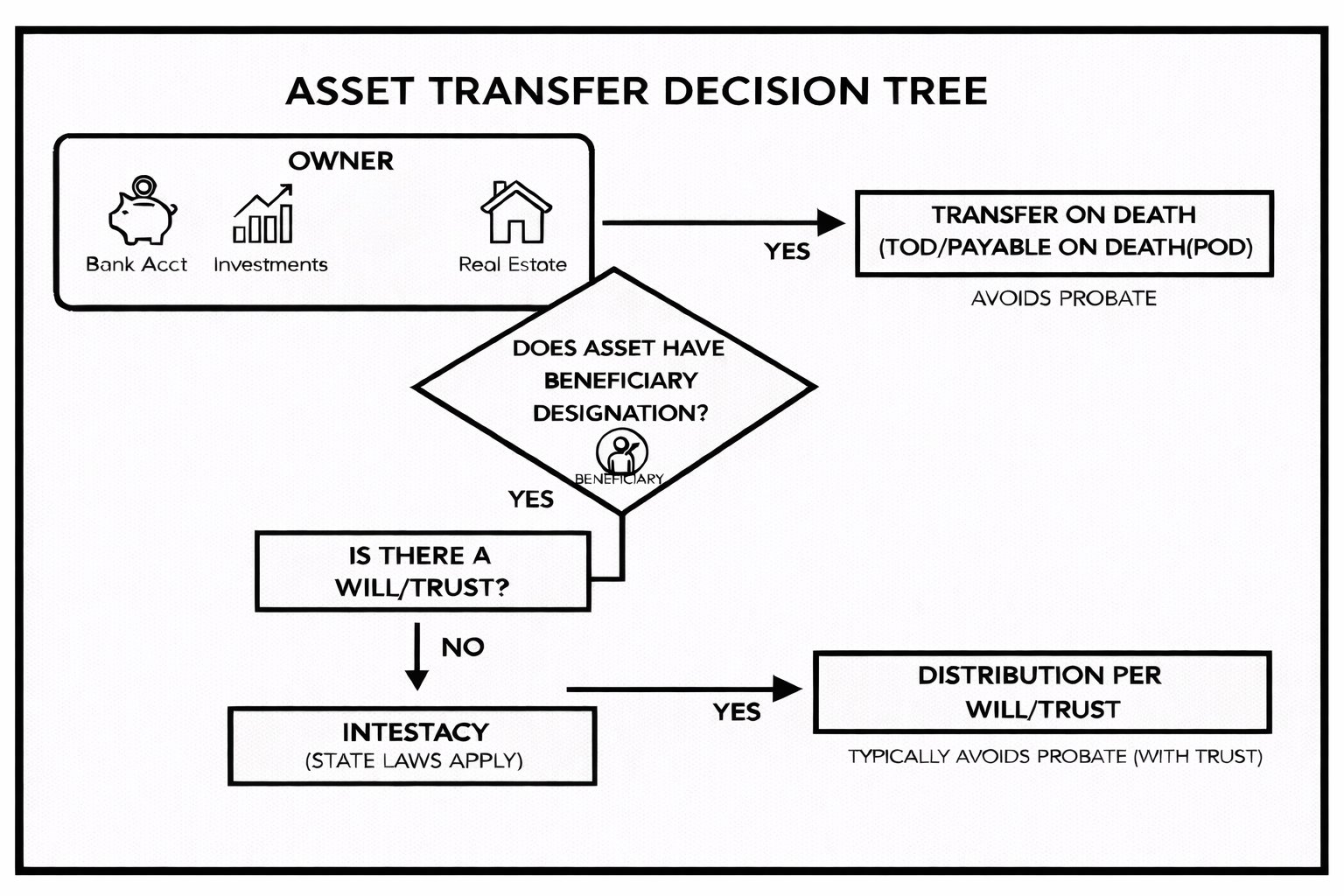

Beneficiary Designations

Certain assets pass directly to named beneficiaries and typically bypass probate.

Common Examples

Retirement accounts

Life insurance policies

Payable-on-death (POD) bank accounts

Transfer-on-death (TOD) investment accounts

Keeping beneficiary designations current is essential to ensure alignment with overall estate plans.

Joint Ownership Structures

Joint ownership may allow assets to pass automatically to a surviving owner, depending on how title is held.

Common Forms

Joint tenancy with right of survivorship

Tenancy by the entirety (available in some states)

While joint ownership can avoid probate, it may introduce other considerations, such as creditor exposure or unintended ownership transfers.

Gifting During Lifetime

Lifetime gifting reduces the size of the probate estate by transferring assets before death.

Key Considerations

Gift tax rules and annual exclusion limits

Loss of control over gifted assets

Impact on long-term financial security

Gifting strategies should be coordinated carefully within broader planning objectives.

Use of Trusts Beyond Revocable Trusts

In some cases, irrevocable trusts may also be used to remove assets from the probate process while supporting additional planning goals such as asset protection or estate tax planning.

Irrevocable trusts involve greater complexity and reduced flexibility compared to revocable trusts.

Small Estate Procedures

Some states offer simplified probate procedures for estates below certain value thresholds. These processes may reduce administrative burden but vary significantly by jurisdiction.

Understanding state-specific rules is important when evaluating planning options.

The Importance of Coordination

Probate avoidance strategies are most effective when coordinated across the entire estate plan.

This coordination often includes:

Wills and trusts

Beneficiary designations

Asset titling

Tax planning considerations

Inconsistent or incomplete planning may reduce the effectiveness of probate avoidance efforts.

When Probate May Still Be Appropriate

In some situations, probate may be straightforward or unavoidable. For example:

Assets not properly titled or designated

Disputes among heirs

Complex creditor issues

Understanding when probate applies helps set realistic expectations.

Conclusion

Avoiding probate is a common estate planning objective, but it requires thoughtful coordination and proper implementation. Tools such as trusts, beneficiary designations, and asset titling may help streamline asset transfer and reduce administrative complexity.

Evaluating these strategies within the context of individual circumstances and state law supports informed estate planning decisions.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investing involves risk, including possible loss of principal. The information presented is for educational purposes only and should not be interpreted as individualized investment, tax, or legal advice. Past performance is not indicative of future results. For more information, please review our Form ADV, available upon request.

Comments