Financial Planning for Foundations: A Strategic Guide

- Oct 27, 2025

- 3 min read

A foundation’s ability to create lasting change depends on the strength of its financial plan. True financial stewardship goes beyond managing assets — it’s about building a sustainable framework that powers your mission for years to come. Effective financial planning for foundations ties every decision and every dollar back to that core purpose.

The Cornerstones of a Foundation's Financial Plan

Managing a foundation’s finances requires more than annual budgeting. It involves creating a structure that marries mission with sound fiscal responsibility. The goal isn’t only to meet this year’s grant targets — it’s to preserve capital so the organization can continue making an impact for generations.

A solid financial plan serves as a North Star for leadership, providing clarity during both strong and uncertain economic cycles. Without it, organizations may react impulsively, risking the erosion of long-term impact.

Building a Mission-Driven Financial Framework

Early decisions — such as choosing between a donor-advised fund and a private foundation — have lasting implications for governance and compliance. Regardless of structure, strong foundations share key elements:

Mission Alignment: Every financial action should advance the core mission.

Governance Clarity: Defined roles and policies build accountability.

Strategic Investment Policy: A clear IPS (Investment Policy Statement) ensures disciplined decision-making.

Sustainable Spending Rules: Balancing current giving with long-term preservation.

When these pillars work together, they create a durable organization that can adapt while staying true to its purpose.

Aligning Mission and Financial Strategy

A mission statement should guide every financial decision. When mission and money are in sync, the organization operates with clarity and purpose, even during market volatility or leadership transitions. This alignment becomes a feedback loop — healthy finances strengthen the mission, and a clear mission guides sound financial choices.

Establishing a Strong Governance Framework

Strong governance transforms vision into action. Clear distinctions between the board, investment committee, and executive staff help maintain order and accountability:

Board of Directors: Custodians of mission and policy.

Investment Committee: Oversees the IPS and portfolio performance.

Executive Staff: Manages day-to-day operations and reporting.

A transparent conflict-of-interest policy and consistent procedures reinforce public trust and can help mitigate risk.

Translating Grantmaking Goals into Financial Strategy

Financial planning and grantmaking are deeply intertwined. A foundation focused on rapid-response initiatives, for instance, needs liquidity; one funding multi-year research can pursue a longer-term investment horizon.

Best practices include:

Mission Audits to ensure investments align with purpose.

Financial Scenario Modeling to forecast future grant capacity.

Program-Finance Collaboration for strategic balance between funding needs and investment growth.

Crafting a Purposeful Investment Policy Statement (IPS)

An IPS acts as the foundation’s strategic investment roadmap. It ensures all financial decisions — across leadership changes — remain rooted in mission.

Defining Risk and Return

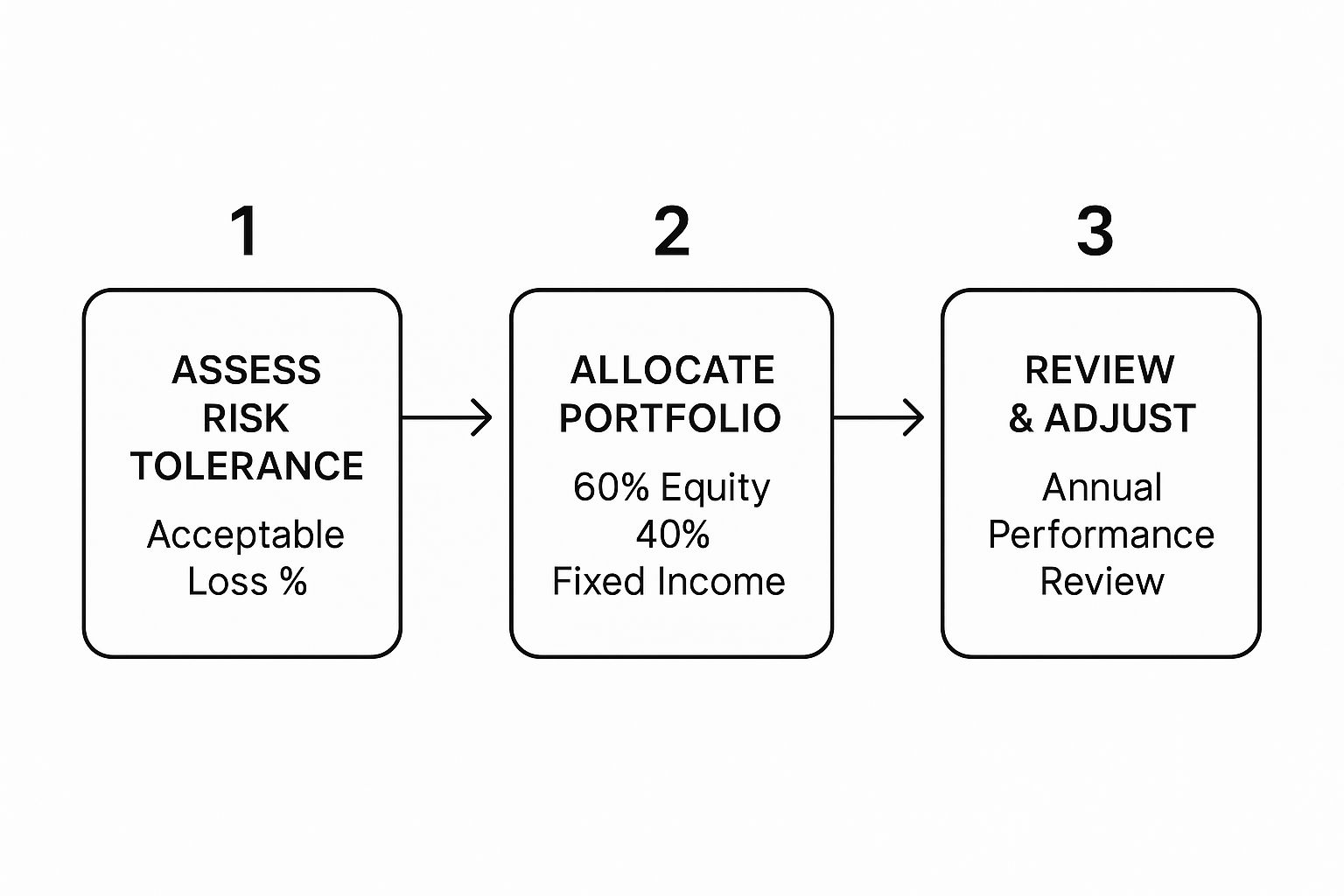

Each foundation must evaluate its unique risk tolerance, liquidity needs, and investment horizon.For example, if a foundation’s spending policy is 5% and inflation is 3%, targeting an 8% annual return may help maintain purchasing power over time.

Implementation steps:

Regular risk assessments and portfolio reviews

Clear rebalancing protocols

Suitable performance metrics tied to mission outcomes

Setting Asset Allocation Guidelines

Asset allocation is the primary driver of long-term returns. The IPS should specify target percentages and tolerance ranges for equities, fixed income, and alternatives. Diversification across geographies and sectors can help mitigate volatility, while rebalancing maintains discipline.

Developing a Sustainable Spending Policy

A spending policy is the heartbeat of a foundation. It balances immediate impact with long-term preservation.

Common approaches:

Fixed Percentage Rule (e.g., 5%) — simple but volatile.

Moving-Average Model (3–5 years) — smooths market fluctuations for predictable grantmaking.

Policies must reflect whether the foundation is perpetual or spend-down. Each requires distinct modeling to sustain commitments.

Integrating Compliance and Risk Management

Regulatory compliance isn’t optional — it’s the foundation of integrity. Private foundations must adhere to Form 990-PF filing, 5% minimum distribution, and self-dealing restrictions. Building a compliance calendar, conducting annual board training, and consulting specialized advisors helps avoid pitfalls.

Broader risk management should address:

Operational Risks: fraud prevention, cybersecurity, succession planning

Reputational Risks: transparency and proactive communication

Investment Risks: ensuring portfolio strategy aligns with liquidity and mission goals

Building a Lasting Philanthropic Legacy

Financial planning for foundations is an evolving process. When governance, mission alignment, investment discipline, and compliance converge, they create a resilient organization capable of growing its impact for decades.

Putting in the effort to design this framework is not just financial management — it’s a direct investment in your mission’s future.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd. and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Please consult with your professional advisors before taking any action. Past performance is not a guarantee of future results.

Comments