Family Trust Pros and Cons: A Guide to Estate Planning

- Jan 29

- 3 min read

Understanding Family Trusts

A family trust is a legal structure used in estate planning to hold and manage assets for the benefit of family members. Family trusts are commonly designed to support long-term wealth transfer, provide structure around asset distribution, and help coordinate estate planning objectives.

Family trusts may be revocable or irrevocable, and the features of each structure influence how assets are managed, taxed, and transferred. This guide provides a general educational overview of key considerations.

How Family Trusts Work

A family trust is established by a grantor, who transfers assets into the trust. A trustee is appointed to manage those assets according to the terms outlined in the trust document, and beneficiaries receive distributions based on defined rules.

The trust document governs:

Distribution timing and conditions

Trustee authority and responsibilities

Provisions for incapacity or succession

Long-term governance structure

Family trusts are often used alongside wills, powers of attorney, and beneficiary designations.

Potential Advantages of a Family Trust

Structured Wealth Transfer

Family trusts allow grantors to specify how and when beneficiaries receive assets. This may help manage distributions across generations and provide protections for beneficiaries who may not be prepared to manage assets independently.

Continuity and Control

Trusts can provide continuity in asset management if the grantor becomes incapacitated or passes away. Trustee succession provisions help ensure ongoing oversight without the need for court involvement.

Privacy

Unlike wills, which may become public record during probate, trusts are generally private documents. This may appeal to families seeking confidentiality around asset distribution.

Probate Avoidance

Assets held in a properly funded trust typically bypass probate, which may reduce administrative delays and costs associated with estate settlement.

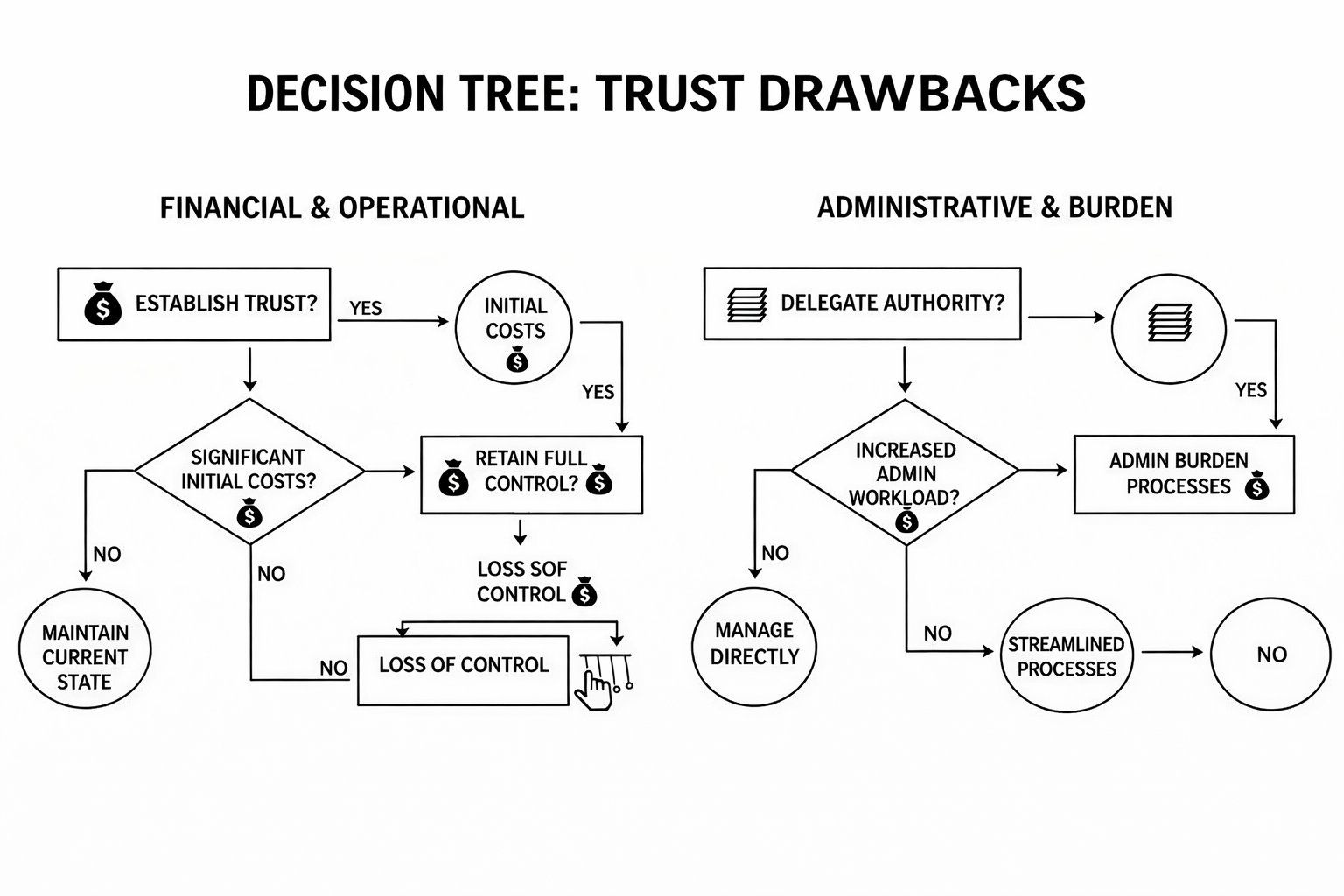

Potential Disadvantages of a Family Trust

Complexity and Cost

Creating and maintaining a family trust often involves legal, administrative, and potentially tax-related costs. These factors may outweigh benefits for smaller or simpler estates.

Ongoing Administration

Trusts require ongoing management, including recordkeeping, tax filings, and trustee oversight. This administrative responsibility continues for the life of the trust.

Reduced Flexibility

Depending on the structure, certain trust provisions may be difficult to modify once established. This can limit adaptability as family circumstances or tax laws change.

Funding Requirements

For a trust to function as intended, assets must be properly titled in the trust’s name. Failure to fully fund the trust may reduce its effectiveness.

Revocable vs. Irrevocable Family Trusts

Family trusts are commonly structured as either revocable or irrevocable.

Revocable Trusts

Grantor retains control and may amend or revoke the trust

Assets are generally included in the grantor’s taxable estate

Commonly used for probate avoidance and incapacity planning

Irrevocable Trusts

Grantor relinquishes control once funded

Assets may be removed from the taxable estate

Often used for advanced estate or asset protection planning

The choice depends on goals related to control, taxation, and long-term planning.

Trustee Selection Considerations

Selecting an appropriate trustee is an important decision. Trustees may be individuals, institutions, or a combination of both.

Key considerations include:

Financial and administrative capability

Impartiality among beneficiaries

Understanding of fiduciary responsibilities

Long-term availability

Trustee selection can influence how effectively the trust operates over time.

When a Family Trust May Be Considered

Family trusts are often evaluated by individuals or families with:

Multiple beneficiaries or blended families

Long-term wealth transfer goals

Privacy or probate avoidance priorities

Concerns around asset management continuity

They are typically part of a broader estate planning strategy.

Conclusion

Family trusts offer a structured approach to managing and transferring assets across generations. While they provide benefits such as control, privacy, and continuity, they also involve complexity and ongoing responsibilities.

Understanding both the advantages and limitations of a family trust can help individuals make informed decisions as part of a comprehensive estate planning process.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investing involves risk, including possible loss of principal. The information presented is for educational purposes only and should not be interpreted as individualized investment, tax, or legal advice. Past performance is not indicative of future results. For more information, please review our Form ADV, available upon request.

Comments