Estate Planning for Business Owners in Ohio: Seeking to Preserve Your Legacy

- Nov 5, 2025

- 5 min read

For many Ohio business owners, their company is far more than an entry on a balance sheet—it represents decades of work and identity. Proper estate planning seeks to ensure that your business, family, and personal assets remain aligned and preserved for generations to come. Without it, even the most successful enterprises can face disruption, legal hurdles, or significant tax exposure.

Why Estate Planning Matters for Business Owners

For entrepreneurs, personal and business finances are deeply intertwined. Your company is often your single largest asset—and that means your family’s long-term financial well-being may depend on its future. A strategic plan addresses not only who inherits ownership, but also how operations continue and how taxes, debts, and liquidity are managed efficiently.

Delaying estate planning leaves major decisions to others and invites conflict. In Ohio, estates without direction can fall into probate, a public process that can freeze assets, complicate leadership transitions, and expose private information.

A proactive estate plan aims to help prevent that uncertainty and maintains both family harmony and business stability.

Core Goals of a Strategic Estate Plan

A comprehensive plan should address the following:

Business Continuity: Seamless leadership transfer and clear operational authority.

Liquidity: Cash to cover taxes and debts without liquidating key assets.

Tax Efficiency: Strategies that help mitigate estate and gift tax exposure.

Family Harmony: Transparency that reduces disputes among heirs and partners.

Succession Planning for Ohio Business Owners

A succession plan can help ensure your company thrives long after your leadership ends. Nearly two-thirds of family-owned businesses have no written succession plan, despite many owners approaching retirement. This gap creates risk—both financially and culturally.

Source: Teamshares, https://www.teamshares.com/resources/succession-planning-statistics/#:~:text=SBA%2C%202022).-,Nearly%20two%2Dthirds%20of%20family%20businesses%20don't%20have%20a,to%20entry%20for%20most%20buyers.-,Nearly%20two%2Dthirds%20of%20family%20businesses%20don't%20have%20a,to%20entry%20for%20most%20buyers)

Passing the Torch to Family

Keeping a business in the family can be rewarding, but it requires professional evaluation. Skills, interest, and readiness must guide who steps in—not assumptions of “fairness.” Open discussions and clear documentation help avoid resentment and tax complications.

Management Buyout (MBO)

Key employees may be the best successors. An MBO allows them to purchase the business—often through seller financing, providing the owner with income during retirement while ensuring operational continuity.

Third-Party Sale

If maximizing value is the goal, selling to an external buyer or private equity group can yield a strong valuation. Engaging a business broker or M&A advisor can help provide confidentiality and structure.

Employee Stock Ownership Plan (ESOP)

An ESOP sells ownership to a trust for employees, fostering loyalty and providing potential tax advantages. Though setup is complex, it has potential to help sustain legacy and employee engagement.

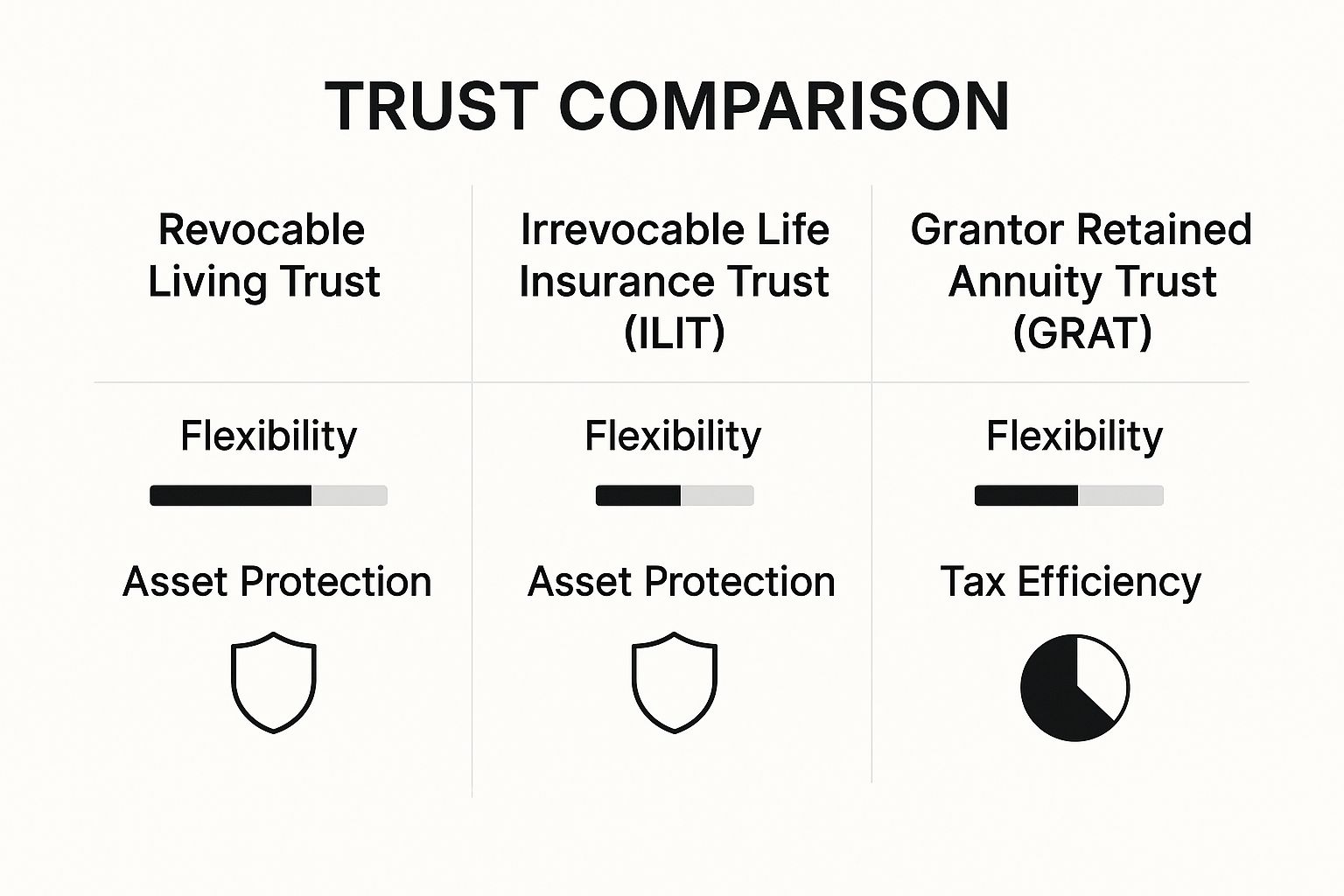

Trusts as Cornerstones of Business Estate Planning

Trusts draw a legal boundary between personal and business assets, which can help serve as a precaution and support efficiency.

Revocable Living Trust (RLT)

An RLT allows flexibility—you retain control while avoiding Ohio probate. Assets pass directly to heirs privately and efficiently.Implementation notes:

Formally retitle assets into the trust.

Choose a qualified successor trustee.

Remember that assets remain part of your taxable estate during your lifetime.

Irrevocable Trusts

Designed with the goal to help preserve assets and mitigate taxation, irrevocable trusts permanently transfer ownership out of your estate.

Common types include:

Irrevocable Life Insurance Trust (ILIT): Creates tax-free liquidity for heirs or business buyouts.

Grantor Retained Annuity Trust (GRAT): Transfers business growth to heirs with limited gift-tax exposure.

Integrating Tax Strategy into Your Estate Plan

Reducing taxes means preserving more of your business’s value for family and community. Here are some options that may be suitable:

Lifetime Gifting: Up to $18,000 per person (2024 limit) can be given annually tax-free, systematically lowering your estate value. - Source: IRS, https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

Valuation Discounts: Applying Discounts for Lack of Control (DLOC) and Lack of Marketability (DLOM) to closely held shares can legitimately reduce gift and estate tax impact.

Charitable Planning: Tools such as Charitable Remainder Trusts (CRTs) enable philanthropy while creating income streams and tax benefits.

Synchronizing Business and Personal Planning

Fragmented planning—one strategy for personal assets, another for the business—creates risk. Aligning both ensures clarity.

Ensure all core documents (operating agreements, wills, trusts) complement each other.

Maintain a buy-sell agreement that defines valuation and funding in the event of death, disability, or retirement. (This option may not be suitable for all investors)

Use life insurance to fund buy-sell agreements and prevent forced sales or debt burdens. (This option may not be suitable for all investors)

Implementation & Ongoing Review

Estate planning is not a one-time task—it evolves with your business and life events.

Build Your Team: Coordinate your attorney, CPA, and financial advisor.

Review Regularly: Every 3–5 years or after major life or tax changes.

Value Your Business Professionally: Accurate valuations drive realistic succession and tax decisions.

Your Top Questions Answered

When you're running a business, estate planning can feel complex. Here are some of the most common questions from Ohio business owners, along with straightforward answers.

Where Do I Even Begin with My Business Estate Plan?

The first move is often getting a professional valuation of your business. This number drives every decision you'll make next, from your succession plan to figuring out potential estate tax liabilities. A formal valuation gives you a clear, defensible figure needed for structuring buy-sell agreements, planning for taxes, and ensuring your heirs are treated fairly.

What's the Importance of a Buy-Sell Agreement?

Think of a buy-sell agreement as a "business prenup." It's a legally binding contract that lays out exactly what happens to an owner's share of the business if they leave. This document specifies "trigger" events—like death, disability, or retirement—and establishes a valuation method ahead of time. This can prevent disputes and guarantees a smoother transition of ownership.

How Often Should I Review This Plan?

Your business estate plan is a living strategy that should evolve with your business and your life. As a general rule, you might review your plan every three to five years, or sooner if a major event occurs, such as a dramatic change in business value, a change in family situation, a shift in business ownership, or updates to federal or Ohio tax laws. Regular check-ins ensure your plan still reflects your wishes and protects the legacy you've built.

At Parkview Partners Capital Management, we understand the unique challenges Ohio business owners face. A comprehensive approach to estate planning for business owners is crucial for long-term success. To discuss how these strategies might apply to your specific situation, contact Parkview Partners Capital Management for a personalized consultation.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation.

Comments