ECONOMIC AND FINANCIAL MARKET UPDATE - NOVEMBER 2025

- Nov 24, 2025

- 7 min read

Recent Market News

After 43 days, the longest U.S. government shutdown in history has come to an end. The Congressional Budget Office estimates that economic growth will temporarily slow at the end of 2025 due to the disruption, as federal spending was paused, fewer services were provided by federal workers, and a temporary reduction in aggregate demand across the economy impacted output by the private sector. In the event of a six-week shutdown, the office estimates that the annualized quarterly GDP growth rate for the fourth quarter of 2025 would be lower by approximately -1.5%, followed by an offsetting rebound in GDP growth in the first quarter of 2026 as federal and consumer spending resumes. Despite fears of economic slowdown and a lack of economic data releases throughout this period, markets have largely disregarded potential impacts from the shutdown, bolstered by continued strength in corporate earnings and expected cuts to the federal funds rate into 2026.1

Additionally, trade tensions between the U.S. and China appear to be easing, as recent negotiations have resulted in China effectively eliminating export controls on rare earth minerals, while the U.S. lowered tariffs on Chinese imports which were initially imposed to combat the flow of precursor chemicals often used in the manufacture of fentanyl. China’s market is open once again to U.S. soybeans and other agricultural exports, and many of the reciprocal tariffs announced by both parties have been suspended or removed. Last week, The White House further adjusted the scope of reciprocal tariffs, citing substantial progress made toward finalizing existing or future trade deals, as well as current domestic demand and domestic capacity constraints for certain products. Certain agricultural products are now exempt from these tariffs, including beef, coffee and tea, fruits and juices, and spices, which should help to counteract inflationary pressures.2 Stay tuned.

Still, the macroeconomic outlook with respect to inflation and labor remains opaque due to uncollected/unreleased data from the government shutdown, some of which may not be available in time for the Fed’s upcoming Open Market Committee Meeting on December 9th and 10th, adding difficulty to its Fed Funds rate decision making. From near certainty prior to the shutdown, the Fed Funds futures markets have been increasingly volatile and are now pricing the odds for a quarter-point cut at the December FOMC meeting at 75%. Despite this headwind, we believe U.S. markets remain well-positioned relative to other developed economies due to the continued strength in corporate earnings as well as the fundamental strength, scale, and composition of leading industries in the U.S. economy (e.g., technology, industrials, financials).

Third Quarter Earnings Season So Far

As the third quarter earnings season comes to a close, results thus far support a strong outlook despite widely anticipated tariff impacts and a cooling labor market in recent months. As of November 14th, with 92% of S&P 500 companies having reported results, 82% outperformed earnings expectations and 76% outperformed revenue expectations, well above long-run (10-year) averages of 75% and 66%, respectively. Currently, the blended earnings growth rate (combining reported results and expected results for companies yet to report) of the S&P 500 is 13.1% year-over-year (vs. 10-year average of 9.5%), which marks the ninth consecutive quarter of earnings growth and the fourth consecutive quarter of double-digit earnings growth. As we expected, muted earnings guidance in recent quarters has contributed in part to the magnitude of earnings and revenue outperformance for Q3 2025.

We continue to emphasize that the market is priced for perfection, as the S&P 500 is currently trading at a forward P/E of 22.4 (vs. 10-year average of 18.7) and as a result, the market is punishing negative earnings performance more than usual. For Q3 2025, companies which have reported negative earnings surprises have experienced an average price decline of -4.9% across the two days prior and two days following the announcement, nearly twice the 5-year average price decline of -2.6%. Furthermore, outperformers are rewarded less for positive earnings surprises, rising only +0.4% for the same period, below the 5-year average price increase of +0.9%.

Considering widely feared negative profitability impacts due to tariff policy, it is remarkable that the blended net profit margin for Q3 2025 is elevated at 13.1%, beating the prior quarter, the year-ago quarter, and the 5-year average. This result marks the highest net profit margin of the S&P 500 since at least 2009, which is the beginning of available FactSet data for this metric. The prior high was Q2 of 2021 when Covid-era business re-openings led an economic rebound. Thus far, seemingly insatiable demand for AI infrastructure, the onshoring and reshoring of domestic manufacturing capacity, and a resilient American consumer continue to support U.S. earnings growth and margin expansion. Analysts expect additional margin improvement into the coming year, with estimates for Q4 2025 through Q2 2026 currently at 12.8%, 13.3%, and 13.7%, respectively.3

A Market Capitalization Study

As discussed above, the current forward P/E of the S&P 500 is elevated relative to historical averages. We believe this is not without reason; in recent decades, the U.S. has outpaced other developed markets due to accelerated economic growth, increased corporate profitability, and more robust investor sentiment. This discrepancy is especially evident in the post-recession era, as displayed below by the chart comparing forward earnings-per-share between the U.S. and the ‘all country world ex-U.S.’ index. Though the gap had widened throughout the prior decade, the post-covid recovery and acceleration in earnings for U.S. companies relative to the ACW ex-U.S. is significant.

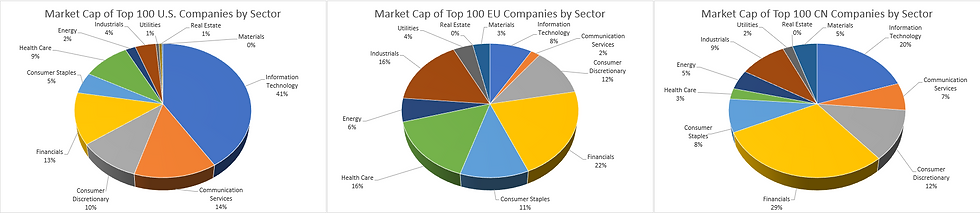

We partially attribute this relative strength in U.S. earnings to the composition and scale of dominant industries within the U.S. economy. Displayed below is a sector breakdown of the top 100 companies by market capitalization of the U.S., EU, and China. The United States economy is more heavily comprised of growth-focused sectors, while the EU and China are more exposed to sectors with less significant growth trends. The information technology sector, for example, constitutes 41% of the market cap of top 100 U.S. companies, vs. 20% in China and only 8% in the EU. Communication services, another growth sector, is responsible for 14% of the market cap of top 100 U.S. companies, vs. only 7% and 2% in China and the EU, respectively. In contrast, the composition of the top 100 companies across the EU and China are more heavily comprised of financials, health care, industrials, energy, utilities, and materials, which have experienced slower growth than technology or communication services in recent years.

To further demonstrate the differences in sector composition, the top 25 companies in each region are listed below, along with their respective recent market values. The rate at which top U.S. companies continue to grow is remarkable, especially considering their substantial size relative to foreign counterparts. The EU’s largest technology company, ASML Holding with a market cap just under $400bn, is roughly the size of CostCo or Bank of America, which come in as the 21st and 22nd largest U.S. companies, respectively. Notable again, is the prevalence of health care, discretionary, and industrials sectors within the top European countries, as well as the concentration of financials, industrials, and materials companies in China, while the U.S. is predominantly led by information technology and communication services sectors.4

Our Thoughts

As we enter the final weeks of 2025, our outlook on the U.S. economy and financial markets remains cautiously optimistic. We acknowledge concerns regarding elevated valuations and continue to closely monitor available economic data with respect to labor, inflation, consumer spending, and economic growth. In time, the resumption of federal economic data releases will provide additional clarity. Currently, corporate earnings continue to surprise to the upside, trade pressures continue to ease, and anticipated tariff-related inflation has yet to appear, which supports a constructive macro environment for equity markets. We maintain our focus on fundamentally strong companies within the technology, communication services, health care, and industrials sectors, which we believe are well positioned to benefit from long-term, productivity-enhancing macroeconomic trends of Artificial Intelligence technology and the continued onshoring/reshoring of domestic manufacturing capacity.

As equity indices have continued to climb to new highs following the April market recovery, we continue to opportunistically and tax-efficiently reallocate risk by reducing equity positions which have become overweighted relative to client investment policy guidelines. Due to significant gains in recent years, and the absence of available offsetting losses, it may become increasingly necessary to realize capital gains as we continue to reallocate risk across client portfolios.

As always, we believe patience, discipline, and maintaining a long-term perspective are of paramount importance in achieving superior long-term absolute positive and relative rates of return. We highly value your relationship and thank you for your confidence. We wish you a wonderful upcoming holiday season and look forward to speaking with you soon.

Sources

4 FactSet Research Systems Inc.

Disclosures

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd. and Parkview Partners Capital Management are separate entities.

The information contained herein has been obtained from sources known to be reliable. However, no guarantee, representation, or warranty, express or implied, is made as to its accuracy, completeness, or correctness.

There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio.

Diversification and asset allocation do not protect against market risk. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Bond yields are subject to change. Certain call or special redemption features may exist which could impact yield.

The opinions voiced in this material are for general information only and not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. Indices are unmanaged and may not be invested into directly. Investing involves risk including loss of principal.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stratos Wealth Partners and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Comments