ECONOMIC AND FINANCIAL MARKET UPDATE - JANUARY 2026

- Jan 21

- 7 min read

Recent Market News – 2025 Recap

Financial markets weathered significant uncertainty throughout 2025 as ongoing geopolitical strife, unpredictable trade policy developments, and a lack of economic data throughout the longest shutdown in U.S. government history clouded the economic outlook. Ultimately, the tariff-induced April downturn was short-lived, economic data releases are now back on schedule, and markets continued to climb to new highs throughout the second half of 2025. Inflation stabilized and remained lower than most analyst estimates throughout the year, oil prices continued their downtrend despite elevated geopolitical tensions, and GDP growth surprised to the upside. As has been the case in recent years, stronger-than-expected corporate earnings continue to drive the market higher, with the S&P 500 recording a third consecutive double-digit total return in 2025 of 17.88%. The tech-heavy Nasdaq returned 21.14%, while the mid and small-cap indices returned 7.50% and 6.02%, respectively.

On a total return basis, all S&P 500 sectors ended the year in positive territory, led by Communication Services, Technology, and industrials, however, market breadth improved a bit more in 2025 as investment began to move away from ‘Magnificent 7’ and broader technology stocks into sectors which are tangentially related to the artificial intelligence buildout (industrials) or are beneficiaries of its productivity enhancements (financials, health care).1

Productivity

For the third quarter of 2025, nonfarm labor productivity (output per hour) increased at an annualized rate of +4.9% from the prior quarter, higher than expectations of a +4.6% increase, marking the fastest pace since Q3 2023 (+6.6%). Output increased at a rate of +5.4% while hours worked increased only +0.5%, indicating that investment and business dynamism continue to drive gains amidst muted labor market conditions.

While quarterly productivity metrics can be volatile, productivity has averaged +2.1% since the pandemic, in-line with the long-term (1947-present) average of +2.1% and above the pre-pandemic trend of +1.4%. We expect further productivity gains – even with less job growth – due to efficiencies realized as a result of continued AI technology investment and implementation across the broader economy, as well as incentives to onshore/reshore manufacturing capacity.2

Labor

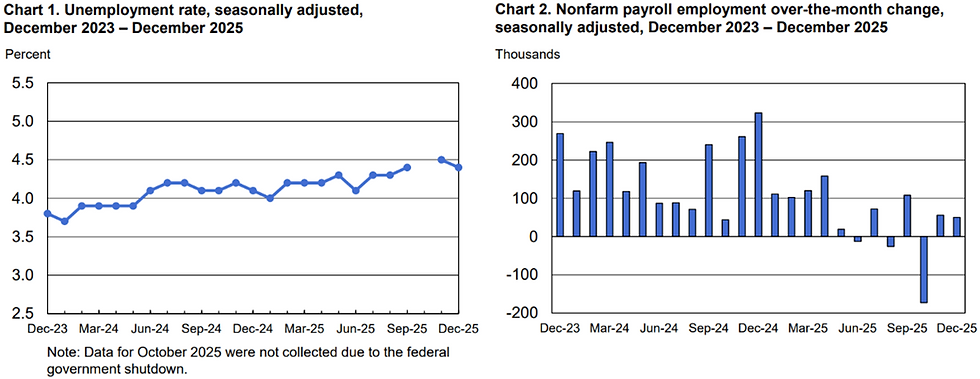

This month brought the first current employment report from the Bureau of Labor Statistics since the federal government shutdown. For December 2025, the U.S. economy added +50k payrolls, lower than estimated +60k. Employment continued to increase in food and beverage services (+27k), health care (+21k) and social assistance (+17k) while retail trade lost jobs (-25k). All other categories showed little or no change. Following the shutdown and subsequent data collection periods, gains across both October and November were downwardly revised by a combined -76k. For the full year 2025, payroll employment rose by +584k, corresponding to an average monthly gain of +49k.

While job creation has softened, the unemployment rate remains historically low, indicative of a no-hire/no-fire labor environment. For December, the unemployment rate was 4.4%, softer than analyst estimates of 4.5% and down from November’s downwardly revised 4.5% (was 4.6%). Economists consider an unemployment rate of 5% or lower to be ‘full employment’ as some flexibility helps to curtail inflation while those seeking full-time employment are able to move between jobs. Still, less-robust labor conditions compared to the same period last year may give the Fed cover to continue cutting the federal funds rate into 2026, despite ongoing debate regarding potential tariff-induced inflation.3

Despite evidence of a stagnant labor market in the BLS employment report, weekly jobless claims remain remarkably well behaved. The chart below displays the prior five years of the 4-week moving average in initial unemployment claims.4

Inflation

The Consumer Price Index remains above the Fed’s 2% annualized target rate of inflation, however, the widely feared increase in inflation to 3-4% in 2025 was not realized. December’s headline figure at 2.7% was in-line with both expectations and the prior reported result. The core CPI figure – which excludes volatile food and energy prices – was 2.6%, slightly softer than expectations of 2.7%. December’s result indicates little change since September, prior to the government shutdown and subsequent data blackout. Following this CPI release on January 13th, the odds of a January rate cut were little changed, further supporting analyst views that the Fed remains focused on the labor market.

GDP Growth

Finally released on December 23rd, the delayed preliminary third-quarter GDP estimate was +4.3%, much stronger than estimates of +3.0%. This marks the strongest quarter of growth since Q3 2023 (4.7%). This GDP growth is primarily attributed to increases in consumer spending, a sharp rebound in exports, and a slight increase in government spending. Fixed investment continued to rise, albeit at a lower pace, and imports declined further from the quarter prior.6

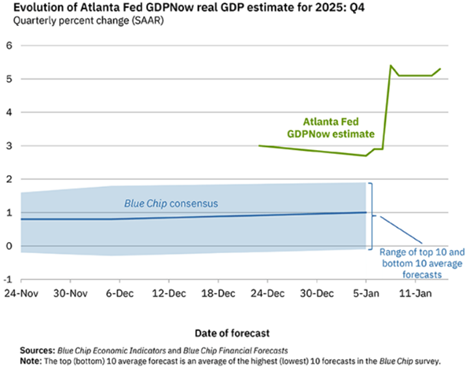

Estimates for the fourth quarter of 2025 via the Atlanta Fed GDPNow model are currently at +5.3% as of January 14th, while the blue chip consensus has trended upward to 1%. It is worth noting that the consensus estimate for Q3 began below 1% and was upwardly revised throughout the quarter to 3.0%, still undershooting the official preliminary result discussed above. As economic data resumes a regular release schedule, we expect additional blue chip consensus revisions throughout the quarter.7

M&A and IPO Strength

As expected, dealmaking activity picked up notably in 2025, with JPMorgan estimating M&A value up 32% annually, matching the 2021 record of $2.7tn. With tariff uncertainty fading, the Fed expected to continue its easing cycle, continued strength in equity markets, and a more permissive antitrust environment in Washington, sentiment for a robust deal market is at a six-year high.8

The IPO market is poised to benefit from the same positive market conditions, especially considering the growing backlog of IPOs delayed by early-year tariff uncertainty and October’s government shutdown. Despite these headwinds, the Q4 2025 marked the strongest quarter for IPOs in more than three years, with full-year deal count and proceeds increasing by 27% and 38%, respectively.

Constructive trends in the M&A and IPO environment are a positive for the U.S. economy, as increased business dynamism improves productivity and drives corporate profits, adding further support to equity markets.

Our Thoughts

We remain constructive on the U.S. economy and market, though we expect to experience heightened volatility as fairly- priced equity markets look to positive returns for a fourth straight year. The underlying fundamentals of the economy and backdrop for the market have improved and remain sound, e.g., declining fed funds rate, softening inflation, improving corporate profits/margins, and increasing productivity. As productivity increases, businesses can produce more product per dollar invested in operations, which leads to higher profits and margin improvement, and also allows companies to adapt to cost increases without raising prices. This backdrop provides a tailwind to the equity market as result of the investment and buildout in AI and as well as the ongoing trend of reshoring.

The consumer remains on solid footing as well. Spending and retail sales remain strong, supported by growth in incomes and net worth, as well as a firm labor market. January 15th jobless claims fell below 200,000 for only the second time since January of 2024. We expect significant tax refunds to buoy the consumer in the first half of 2026 but acknowledge the concern that it may have an inflationary impact – stay tuned. Energy prices continue to drift lower as supply outweighs demand, and recent developments in Venezuela could cause further price declines in oil – a positive for the consumer. As we start the new year, we remain concerned about housing affordability and maintain an increased focus on geopolitical events/shocks. As always, it will be something that we aren’t expecting that will shake the market and/or the psyche of the U.S. consumer, e.g., a black swan event (Greenland, Iran, Ukraine, etc...). We remain focused on the underlying fundamentals of the economy and the health of consumer in positioning client portfolios.

We will continue to modestly and tax efficiently reduce equities to adhere to client’s memorialized investment policy statements if equities continue to perform positively, staying balanced. We remain committed to goals of consistent growth of principal and income through disciplined strategic diversification, our focus on investments with superior fundamental characteristics, and remaining balanced to reduce risk and improve preservation of capital. We review with clients that long-term capital gains should and may be considered to be realized in non-qualified accounts as a result of above equity historical rates of returns the past three years. We look forward to discussing this with you in greater detail.

As always, we believe patience, discipline, and maintaining a long-term perspective are of critical importance to achieving superior long-term absolute positive and relative rates of return. We highly value your relationship and thank you for your confidence that you place in us. We wish you a blessed and healthy 2026 and look forward to speaking with you soon.

Sources

1 FactSet Research Systems

Disclosures

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd. and Parkview Partners Capital Management are separate entities.

The information contained herein has been obtained from sources known to be reliable. However, no guarantee, representation, or warranty, express or implied, is made as to its accuracy, completeness, or correctness.

There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio.

Diversification and asset allocation do not protect against market risk. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Bond yields are subject to change. Certain call or special redemption features may exist which could impact yield.

The opinions voiced in this material are for general information only and not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. Indices are unmanaged and may not be invested into directly. Investing involves risk including loss of principal.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stratos Wealth Partners and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Comments