ECONOMIC AND FINANCIAL MARKET UPDATE - JULY 2025

- Jul 11, 2025

- 6 min read

Updated: Aug 12, 2025

Recent Market Trends

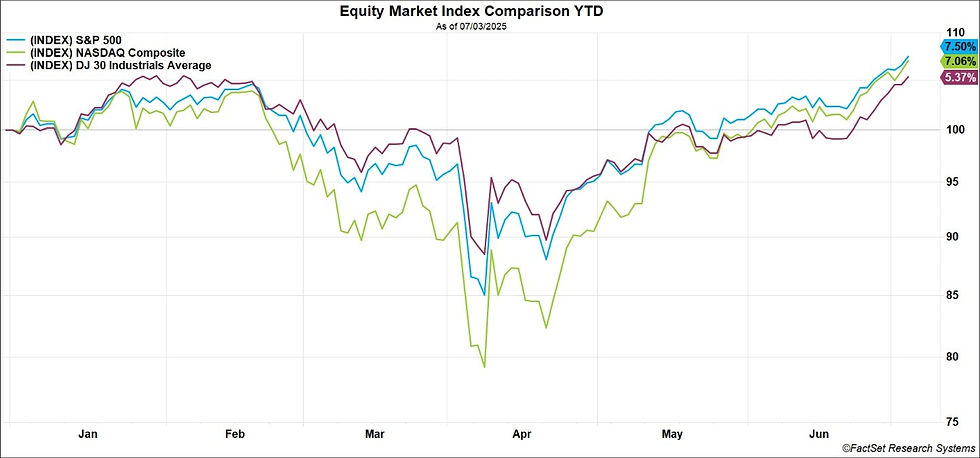

Throughout June, the U.S. stock market continued its recovery following April’s selloff and subsequent tariff pause. Despite significant geopolitical volatility, easing trade tensions and anticipation of impending deals proved to be a tailwind for markets throughout the second quarter as investor sentiment began to rebound. This renewed investor confidence, further supported by strong corporate earnings results throughout the quarter, drove large-cap U.S. indices to record highs prior to the July 4th holiday.1

Elevated uncertainty throughout the first half of 2025 highlighted a discrepancy between deteriorating ‘soft’ data (measures of sentiment or expectations) and remarkably resilient ‘hard’ data (objective and quantifiable economic measurements) which continues to support our cautiously optimistic outlook.

Oil Market Recap

Escalation in the conflict between Israel and Iran throughout June led to a short-lived spike in oil prices which reached an intra-day peak of $80 per barrel on June 22nd.1 Following U.S. intervention in Iran, prices fell quickly and closed at $67/bbl on July 3rd. On July 5th, OPEC+ announced an agreement to raise oil output to 548,000 barrels per day in August, an increase of 33% from the 411,000-barrel level seen in the three months prior.

Interestingly, this marks a significant change in strategy as OPEC+ prioritizes revenue-by-volume as opposed to cutting supply to support prices as it did throughout 2022 and 2023. The organization now faces stronger competition from non-OPEC+ producers, namely the United States.2 In any case, lower oil prices remain a positive for the consumer both at the gas pump and across the broader economy, as lower input/supply chain costs for goods and services may help to offset tariff pricing impacts.

Economic Growth

U.S. Bureau of Economic Analysis GDP (Third Estimate)

Real gross domestic product (GDP) decreased at an annual rate of -0.5% in the first quarter of 2025, more than the expected -0.2% decline. This downward movement is primarily attributed to an outsized increase in imports as companies front-run anticipated tariff pricing impacts, as well as a decrease in government spending. These movements were partly offset by increases in investment and consumer spending.3 While a negative quarter of GDP growth is uncommon during an expansionary period, it is not altogether indicative of a recession.

Federal Reserve Bank of Atlanta GDPNow

As of July 9th, the Atlanta Fed GDPNow estimate for second quarter GDP growth is 2.6%. Recent upward revisions in the model were attributed to growth in exports, personal spending, and non-residential investment. Recent downward revisions in the model were primarily attributed to declines in private inventories.4

Blue Chip Financial Forecasts – top analysts’ outlook for the year ahead – are beginning to narrow as the trade policy outlook begins to solidify, now ranging from 0%-3.5% growth with the consensus just under 2.0%. Estimates in positive territory indicate that forecasters are not anticipating two consecutive quarters of negative GDP growth, which is commonly viewed as a recession indicator.

GDPNow is not an official forecast of the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter.5

Inflation Data

Bureau of Economic Analysis Personal Consumption Expenditures

Per the June 27th report, the Personal Consumption Expenditures (PCE) price index rose +0.1% in May, or +2.3% annualized. The core reading (which excludes volatile food and energy prices) increased +0.2%, or +2.7% annualized. Though both readings remain above the +2.0% annualized target rate, they are up only marginally from April, which was the softest result in seven months. It is important to note that at +3.4% year-over-year, services remain responsible for much of the upward movement in inflation, while goods are up just +0.1% over the same period.6

Since 2000, the Federal Reserve has utilized the PCE price index as its preferred measure of inflation as it better reflects changes in consumer spending and covers a broader range of spending than comparable alternatives. It is also weighted by data supplied by business surveys, which tend to be more reliable than consumer surveys.7

Labor Data

U.S. Bureau of Labor Statistics Employment Situation

The June employment situation (released July 3rd) was stronger than expected as nonfarm payroll employment rose by +147k, greater than estimates of +130k. Additionally, both April and May were upwardly revised from 147K to 158K and 139K to 144K, respectively. The unemployment rate ticked down to 4.1% vs. an expected increase to 4.3%. The unemployment rate has remained within a narrow range of 4.0-4.2% since May 2024, below the 5% threshold which historically reflects full employment.

Job gains were led by state/local government (+73k), health care (+39k), social assistance (+19k), and construction (+15k). Federal government led job losses (-7k), now down by -69k since January. It is important to note that employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey, so the impacts of the ‘Department of Government Efficiency’ are likely to continue to be felt in coming months.8 Stocks rose on the news of the continued resilience in the labor market, while odds of a July Federal Funds rate cut vanished. The Fed remains in ‘wait-and-see’ mode amidst encouraging ‘hard’ data.

Sentiment and Confidence

UofM Consumer Sentiment Survey (final)

Consumer sentiment rebounded 16% to 60.7 in June, better than expectations of 59.8 and up from 58.9 in May, marking the first increase in six months. Metrics improved broadly across numerous facets of the economy, with expectations for personal finances and business conditions climbing 20% or more. Despite June’s gains, sentiment remains approximately 18% below the December 2024 post-election peak. Consumer views still broadly reflect expectations of an economic slowdown and an increase in inflation in coming months, however, year-ahead inflation expectations decreased significantly to the lowest reading since February, near 2022 peak levels. Consumers continue to express concern over potential tariff impacts, but they do not appear to be concerned about geopolitical conflicts in the Middle East/Eastern Europe negatively affecting the economy.9

Our Thoughts

As we expected, U.S. markets have experienced elevated volatility throughout the first half of 2025 as a result of ongoing geopolitical conflict, tumultuous trade negotiations, waning sentiment/confidence, and the impact of the policies of a new administration. In recent months, market reactions to uncertainty have been muted, but will likely persist until additional clarity on policy materializes. Despite these developments, stocks are trading near all-time highs and the broader economy remains remarkably resilient. Inflation continues to moderate, oil prices remain largely below 2021-2024 levels, the labor markets remain stable, and waning sentiment metrics appear to be reaching an inflection point. As always, we continue to closely monitor these trends.

Expected cuts to the Federal Funds rate as soon as September are likely to provide relief to lending markets and should spur consumer spending, which has tapered in recent months. We also anticipate deregulation, corporate tax cuts, and trade policy developments to further support the long-term economic trends of the onshoring/reshoring of manufacturing capacity as well as the development and implementation of artificial intelligence technologies. These trends remain imperative to our constructive outlook, and we expect meaningful productivity gains as a result.

As always, we believe patience, discipline, and maintaining a long-term perspective are of paramount importance in achieving superior long-term absolute positive and relative rates of return. We highly value your relationship, thank you for your confidence, and look forward to meeting you soon. We wish you an enjoyable and safe summer.

Sources

Disclosures

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd. and Parkview Partners Capital Management are separate entities.

The information contained herein has been obtained from sources known to be reliable. However, no guarantee, representation, or warranty, express or implied, is made as to its accuracy, completeness, or correctness.

There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio.

Diversification and asset allocation do not protect against market risk. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Bond yields are subject to change. Certain call or special redemption features may exist which could impact yield.

The opinions voiced in this material are for general information only and not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. Indices are unmanaged and may not be invested into directly. Investing involves risk including loss of principal.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stratos Wealth Partners and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Comments