Capital Gains vs Ordinary Income: Tax Planning Strategies

- 3 days ago

- 3 min read

Understanding Capital Gains and Ordinary Income

Capital gains and ordinary income are taxed differently under U.S. tax law, and understanding the distinction is an important part of long-term financial planning. The way income is classified can influence overall tax liability and after-tax outcomes.

This guide provides an educational overview of how capital gains and ordinary income are defined, how they are taxed, and common planning considerations associated with each category.

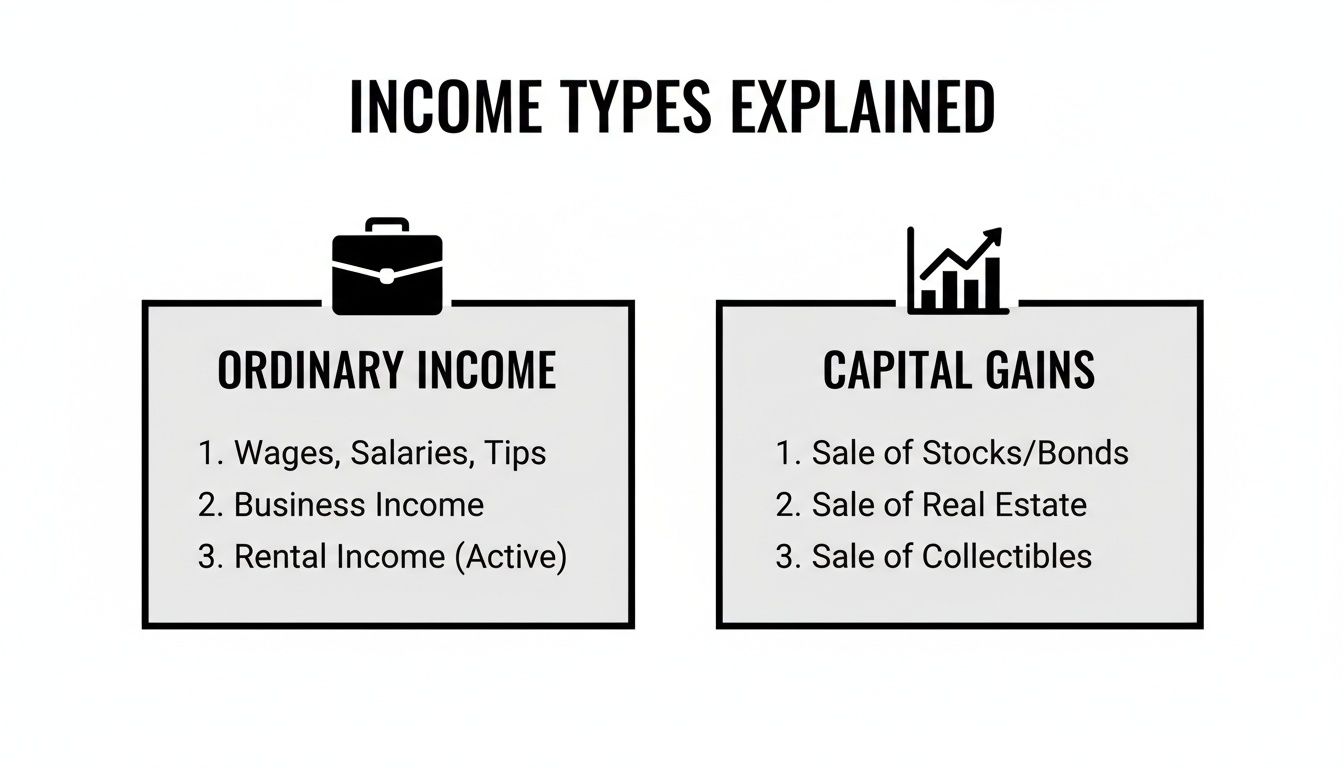

What Is Ordinary Income?

Ordinary income generally includes compensation and earnings received through regular activities.

Common sources include:

Wages and salaries

Bonuses and commissions

Interest income

Short-term investment gains

Retirement account distributions from traditional IRAs or 401(k)s

Ordinary income is typically taxed at progressive marginal tax rates based on income level.

What Are Capital Gains?

Capital gains arise when an asset is sold for more than its purchase price (adjusted basis).

Short-Term Capital Gains

Apply to assets held for one year or less

Generally taxed at ordinary income tax rates

Long-Term Capital Gains

Apply to assets held for more than one year

Generally taxed at preferential rates under current law

Holding period plays a central role in determining tax treatment.

Why the Distinction Matters

The difference between capital gains and ordinary income can meaningfully affect after-tax results. Long-term capital gains rates are often lower than ordinary income tax rates, which may influence decisions around investment timing, asset location, and withdrawal strategies.

Tax planning typically focuses on managing the character of income in addition to the amount.

Timing Considerations

Timing can influence whether income is taxed as ordinary income or capital gains.

Examples include:

Delaying the sale of appreciated assets to qualify for long-term capital gains treatment

Spreading income or gains across tax years

Coordinating sales with years of lower taxable income

Timing strategies must be evaluated within the context of cash-flow needs and market considerations.

Asset Location and Tax Character

Where assets are held can affect how income is taxed.

Taxable accounts: Capital gains are generally recognized when assets are sold

Tax-deferred accounts: Withdrawals are typically taxed as ordinary income

Tax-free accounts: Qualified withdrawals may not be taxed

Strategic asset location may help align tax treatment with long-term objectives.

Tax-Loss Harvesting

Tax-loss harvesting involves realizing investment losses to offset capital gains.

Key points include:

Capital losses may offset capital gains dollar-for-dollar

Excess losses may offset a limited amount of ordinary income

Unused losses may be carried forward

Tax-loss harvesting is subject to IRS rules and timing restrictions.

Retirement Planning Considerations

During retirement, withdrawals from different account types may be taxed differently.

Planning considerations often include:

Coordinating withdrawals across account types

Managing taxable income to remain within certain tax brackets

Evaluating the impact of withdrawals on capital gains taxation

Distribution strategy plays an important role in overall tax efficiency.

State and Local Tax Considerations

In addition to federal taxes, state and local tax rules may apply differently to capital gains and ordinary income. Some states tax both at the same rate, while others offer preferential treatment.

Understanding jurisdiction-specific rules adds clarity to planning decisions.

Integrating Tax Planning Into a Broader Strategy

Tax planning is most effective when integrated with:

Investment strategy

Retirement income planning

Estate and legacy planning

Charitable giving strategies

Coordination across these areas helps ensure tax considerations support broader financial goals.

Conclusion

Understanding the difference between capital gains and ordinary income is a foundational element of tax-aware financial planning. By considering income character, timing, and account structure, individuals can make more informed decisions that support long-term objectives.

Because tax laws are complex and subject to change, professional guidance is often an important part of evaluating tax planning strategies.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investing involves risk, including possible loss of principal. The information presented is for educational purposes only and should not be interpreted as individualized investment, tax, or legal advice. Past performance is not indicative of future results. For more information, please review our Form ADV, available upon request.

Comments