Bonds vs Bond Funds: A Guide for Modern Investors

- Nov 12, 2025

- 9 min read

This content is for informational purposes only and does not constitute financial, legal, or tax advice. Please consult a licensed professional for advice specific to your situation.

The core difference between bonds vs bond funds may boil down to structure and control. An individual bond can be thought of as a direct loan an investor makes with a fixed end date, while a bond fund is a perpetual, managed portfolio of many different bonds. An investor’s choice may depend on what they value more: a potentially less speculative cash flow and the return of principal, or instant diversification and professional management. Making an informed decision between these two options is a key component of wealth management.

Understanding Bonds vs Bond Funds at a Glance

When navigating the world of fixed-income, the "bonds vs bond funds" decision is one of the first and most important an investor might make. It’s a foundational choice for anyone looking for less volatility and income-generating potential to their portfolio as part of their wealth management strategy.

An individual bond is relatively straightforward. An investor is loaning money directly to an entity, like a corporation or a government. In return, they may receive predictable interest payments (coupons) and their original investment (principal) back on a specific date, as long as the issuer doesn't default. This structure can provide a known cash flow, which may be helpful for planning around specific financial goals.

Bond funds, on the other hand, can offer instant diversification. They pool money from many investors to buy a portfolio of bonds, all managed by a professional. These funds don't have a maturity date; instead, the fund manager is always buying and selling bonds to meet the fund's objectives. While this may spread out the risk of any single company defaulting, it introduces new factors like management fees and a share price (the Net Asset Value or NAV) that can fluctuate daily.

This guide intends to provide a balanced look at both options, helping to illustrate where each might fit strategically. By understanding these nuances, an investor and their financial advisor can work to determine which path may align best with a long-term financial plan.

Quick Comparison: Key Differences

For a quick snapshot of how these two investment vehicles stack up, this table highlights their most important distinctions.

Characteristic | Individual Bonds | Bond Funds |

|---|---|---|

Return of Principal | Principal is returned at a specific maturity date, assuming no issuer default. | No maturity date; principal value (NAV) fluctuates and is not guaranteed. |

Income Stream | Fixed coupon payments may provide a predictable income stream. | Income can vary based on the fund's holdings and strategy. |

Diversification | May require significant capital to build a diversified portfolio of individual bonds. | Offers immediate diversification across many issuers, sectors, and maturities. |

Management | Self-managed; investor selects and monitors each bond. | Professionally managed by a fund manager who makes all buy/sell decisions. |

As one can see, the trade-offs are clear. Individual bonds may offer a degree of certainty, while bond funds can provide convenience and scale.

The Mechanics of Bonds vs Bond Funds: A Deeper Dive

To get a handle on the bonds vs bond funds debate, one must look at how each one works. They might both exist in the fixed-income world, but their mechanics can be quite different, which can have significant implications for a portfolio.

An individual bond can be thought of as a straightforward IOU. An investor lends money directly to an organization, whether it's a company or a government. The appeal of this arrangement may be its predictability. The issuer agrees to send regular interest payments, called coupons, and then return the original investment—the principal—on a set date.

As long as the issuer does not go bankrupt, an investor knows how much money they are scheduled to receive and when. For anyone trying to plan for a specific expense or seeking a steady, reliable income source, that kind of structure may be valuable.

How Bond Funds Work

Bond funds, whether they're mutual funds or ETFs, are a different instrument altogether. They work by pooling money from thousands of investors and using that capital to buy a portfolio of different bonds. A professional manager is at the helm, constantly steering the portfolio according to a specific strategy.

A bond fund does not have a maturity date like a single bond does; it is designed to run indefinitely. The manager is always in the market, buying new bonds and selling old ones, so the fund's holdings are in a constant state of flux. Your share in the fund is priced by its Net Asset Value (NAV), which is recalculated daily. The NAV can fluctuate based on the market value of all the bonds in the portfolio, reacting to shifts in interest rates, credit ratings, and general market sentiment.

Implementation Considerations

Individual Bonds: For this approach to be effective, an investor should be comfortable selecting appropriate bonds and monitoring their credit quality. Building a truly diversified portfolio this way may also require a significant amount of capital.

For Bond Funds: Here, an investor is entrusting a professional to make selections. The task is to vet the fund itself—its strategy, fees, and the manager’s performance history—to ensure it is a suitable fit for one's own financial goals.

A Nuanced Comparison of Key Characteristics

Choosing between individual bonds and bond funds means looking past surface-level definitions. The right answer for an individual may depend on the details of risk, the desired level of control, and the costs involved. A direct, side-by-side look can help expose the critical trade-offs.

At its core, the bonds vs bond funds debate often comes down to how one wishes to approach risk. Both are exposed to market forces, but the way that risk appears in a portfolio can be worlds apart.

Unpacking the Layers of Risk

Interest rate risk is a major consideration for any fixed-income investor. When market rates climb, the value of existing bonds with lower payouts tends to fall. If an investor owns an individual bond and plans to hold it to maturity, this may be less of a concern, as they are still scheduled to get their full principal back on a specific date. A bond fund, however, lives with this risk perpetually. Because a fund never "matures," its Net Asset Value (NAV) will rise and fall with changes in the interest rate market. This means the value of the principal is always in flux.

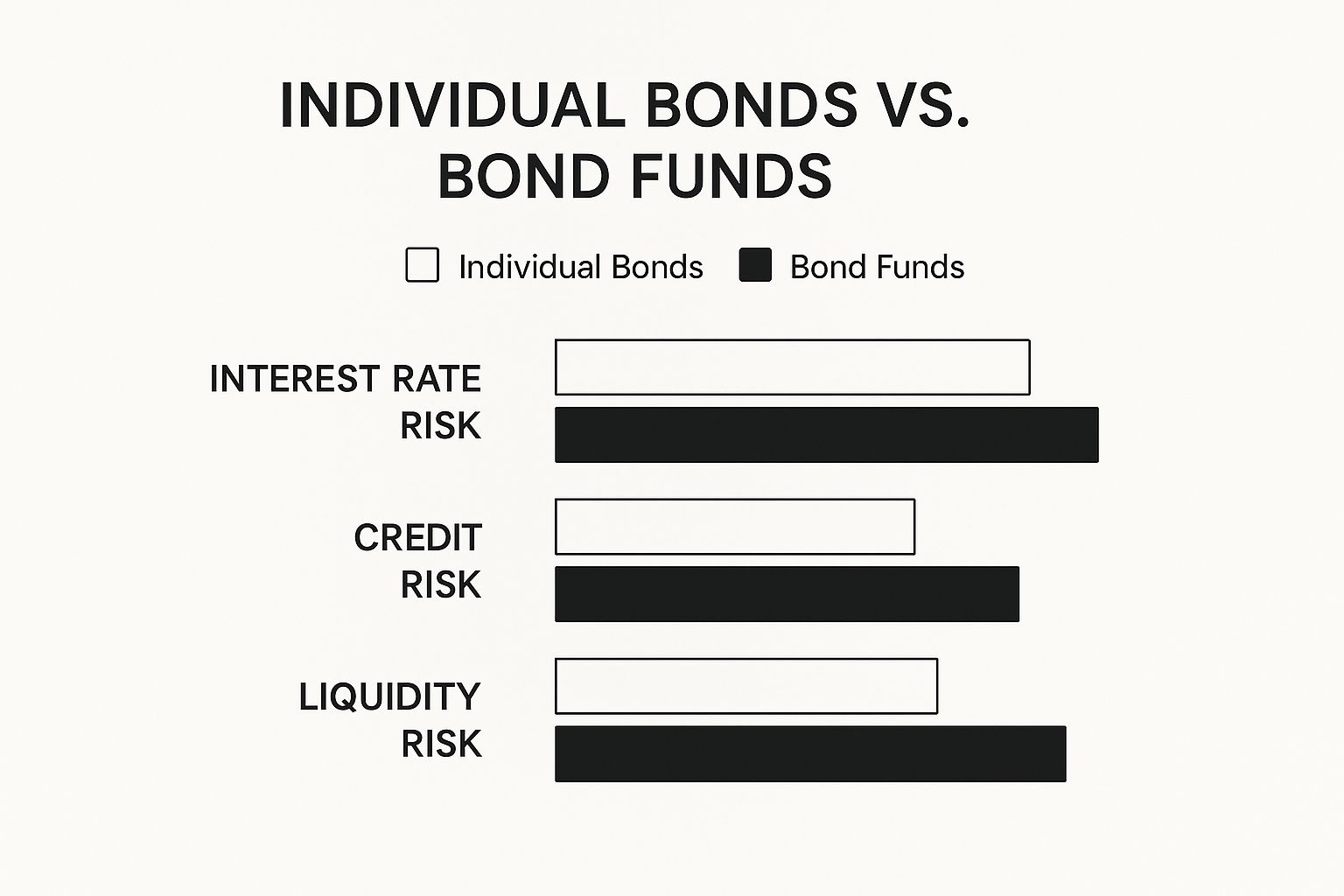

The infographic below gives a visual of how different risks may play out between the two.

As the chart shows, neither option is without risk. Bond funds can spread out credit risk, but they may leave an investor more exposed to the daily price swings caused by interest rate changes.

Then there's credit risk—the chance an issuer cannot pay you back. With a single bond, an investor is tied to the financial fate of that one entity. One can attempt to mitigate this risk by building a portfolio of 20 to 30 individual bonds, but that may take significant capital. Bond funds can address credit risk almost instantly. They pool investor money to buy hundreds, sometimes thousands, of different bonds. If one issuer defaults, the impact to the overall portfolio is usually small.

Control and Transparency in Your Portfolio

The amount of control an investor has is a significant dividing line in the bonds vs bond funds discussion. When you buy an individual bond, you are in control. You pick the issuer, the credit quality, and, most importantly, the exact maturity date that fits a personal financial timeline. This direct ownership provides transparency. You know precisely what you own and can track the issuer's financial health.

With a bond fund, you delegate management to a professional. You own shares in a large, shifting portfolio, not the underlying bonds themselves. The manager makes all the buy and sell decisions based on the fund's strategy, and the holdings can change daily. It’s convenient, but you give up direct control and customization.

Implementation Considerations

Individual Bonds: One possible strategy for investors is building a "bond ladder." By staggering maturity dates, one can create anticipated cash flow patterns and get principal back at specific, planned intervals.

Bond Funds: A potential fit for those who prefer a hands-off approach, want immediate diversification, and are looking to easily access specific corners of the bond market (like high-yield, international, or inflation-protected securities).

Examining the Cost Structures

Fees can impact returns, and the way costs are structured for bonds versus bond funds is completely different. When buying individual bonds, one may encounter transaction costs, such as a direct commission or a "markup" baked into the bond's price. These are one-time costs, but they can add up when building a diversified portfolio.

Bond funds operate on an ongoing fee model called the expense ratio. This is an annual fee, expressed as a percentage of the investment, that covers management and operational costs. Though the percentage might seem small, it's charged year after year and compounds over time, which can impact long-term returns. The choice may come down to a preference for transactional costs upfront versus a smaller, recurring annual fee.

Strategic Use Cases in a Diversified Portfolio

The real "bonds vs bond funds" debate isn't about which is better overall, but which is the right tool for the job at hand. When viewed through the lens of actual financial planning, their distinct roles may become clearer.

An investor saving for a specific, time-sensitive goal might have different needs than someone who wants broad, steady exposure to the fixed-income market. Each vehicle is designed with a goal to solve a different problem.

Customizing Cash Flows with Individual Bonds

Individual bonds can be potentially useful when a projected amount of money is needed on a specific date. This precision may make them suitable for liability-driven investing—matching assets to future expenses. A common example of this is building a bond ladder. An investor could buy several high-quality bonds with maturities that line up with college tuition payments, a down payment on a house, or planned retirement dates. As each bond matures, the principal is returned when needed, and the coupon payments provide an income stream in the meantime.

With individual bonds, an investor can effectively lock in both a return and a principal payout date. This may create a level of certainty that is difficult to achieve with a bond fund, where the principal value is never guaranteed to be a specific amount on a specific day.

Exploring Broad Exposure with Bond Funds

Bond funds, on the other hand, are a common choice for a core strategic holding. They are designed for general portfolio diversification and income generation, not for targeting a single future expense. This method can be incredibly efficient and may save an investor from managing a portfolio of individual securities. Bond funds can also make it simple to make tactical shifts in a portfolio. If an investor and their advisor identify a potential opportunity in a specific corner of the market—like high-yield corporate debt or emerging market bonds—a specialized fund may offer instant, diversified access.

Implementation Considerations

Core Holdings: A broad-market, investment-grade bond fund has the potential to provide a stabilizing influence for a portfolio, providing a source of income and a potential buffer against volatility.

Satellite Positions: Specialized funds—like those focused on inflation-protected securities (Treasury Inflation-Protected Securities) or international bonds—can be used to act on a specific market outlook or hedge against certain economic risks.

To get the most out of either approach, a solid grasp of mastering risk and diversification is helpful. These concepts are the bedrock of many resilient financial strategies.

So, Which is Right for You? Bonds or Bond Funds?

When it comes to the bonds vs bond funds debate, there is no single right answer. The best choice often comes down to what an investor is trying to accomplish with their money. It’s a personal decision that can hinge on one's financial situation, risk tolerance, income needs, and how hands-on they want to be with their investments.

The two options are simply different tools for different jobs. Understanding the subtle differences in risk, cost, and control can help you have a more informed conversation with your financial advisor. It puts you in a better position to determine if individual bonds, bond funds, or even a mix of both, is the right move for your overall wealth management plan.

Putting It All Together: Real-World Scenarios

To make this more concrete, let's look at a few situations where one might be a better fit than the other.

You Need Cash on a Specific Date: Imagine setting up a trust or knowing you have a large college tuition bill coming due in five years. Building a ladder of individual bonds may make sense here. Their fixed maturity dates mean you anticipate when you are scheduled to get your principal back, which may provide that cash flow precision when needed.

You're Building a Diversified Core Portfolio: For many investors, a bond fund can be a simple way to get broad, efficient fixed-income exposure. It may be a suitable foundational piece for a portfolio, offering instant diversification and professional management without the need to research, buy, and track dozens of individual bonds.

You Want to Make a Tactical Move: Let’s say you believe international debt or high-yield bonds are positioned to perform well based on current economic trends. A bond fund can be a useful tool for this. It may allow you to easily add targeted exposure to specific corners of the market as part of a more active strategy.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. This article is for informational purposes only and is not intended as investment, legal, or tax advice. Please consult with your professional advisors before taking any action. Past performance is not a guarantee of future results.

To discuss how these strategies might apply to your specific situation, contact Parkview Partners Capital Management for a personalized consultation.

Comments