A Guide to the Net Unrealized Appreciation Tax Strategy

- Jan 12

- 3 min read

Understanding the Net Unrealized Appreciation Concept

Net Unrealized Appreciation (NUA) is a tax treatment that may apply to employer stock held within certain qualified retirement plans, such as a 401(k). Under specific conditions, a portion of the value of employer stock may be taxed at long-term capital gains rates rather than ordinary income rates when distributed.

This strategy is complex and subject to strict IRS rules. The following overview is intended for general educational purposes and should be evaluated within the context of individual circumstances.

What Net Unrealized Appreciation Represents

NUA refers to the difference between the original cost basis of employer stock inside a retirement plan and its fair market value at the time of distribution.

Cost basis: The original purchase price of the stock within the plan

Net unrealized appreciation: The growth in value above that cost basis

When NUA treatment applies, these two components may be taxed differently.

How NUA Is Typically Taxed

Under qualifying circumstances:

The cost basis of the employer stock is generally taxed as ordinary income in the year of distribution

The NUA portion may be taxed at long-term capital gains rates when the stock is later sold

Any additional appreciation after distribution is typically taxed according to standard capital gains rules.

This tax treatment differs from the standard rollover of retirement plan assets, which are usually taxed entirely as ordinary income upon withdrawal.

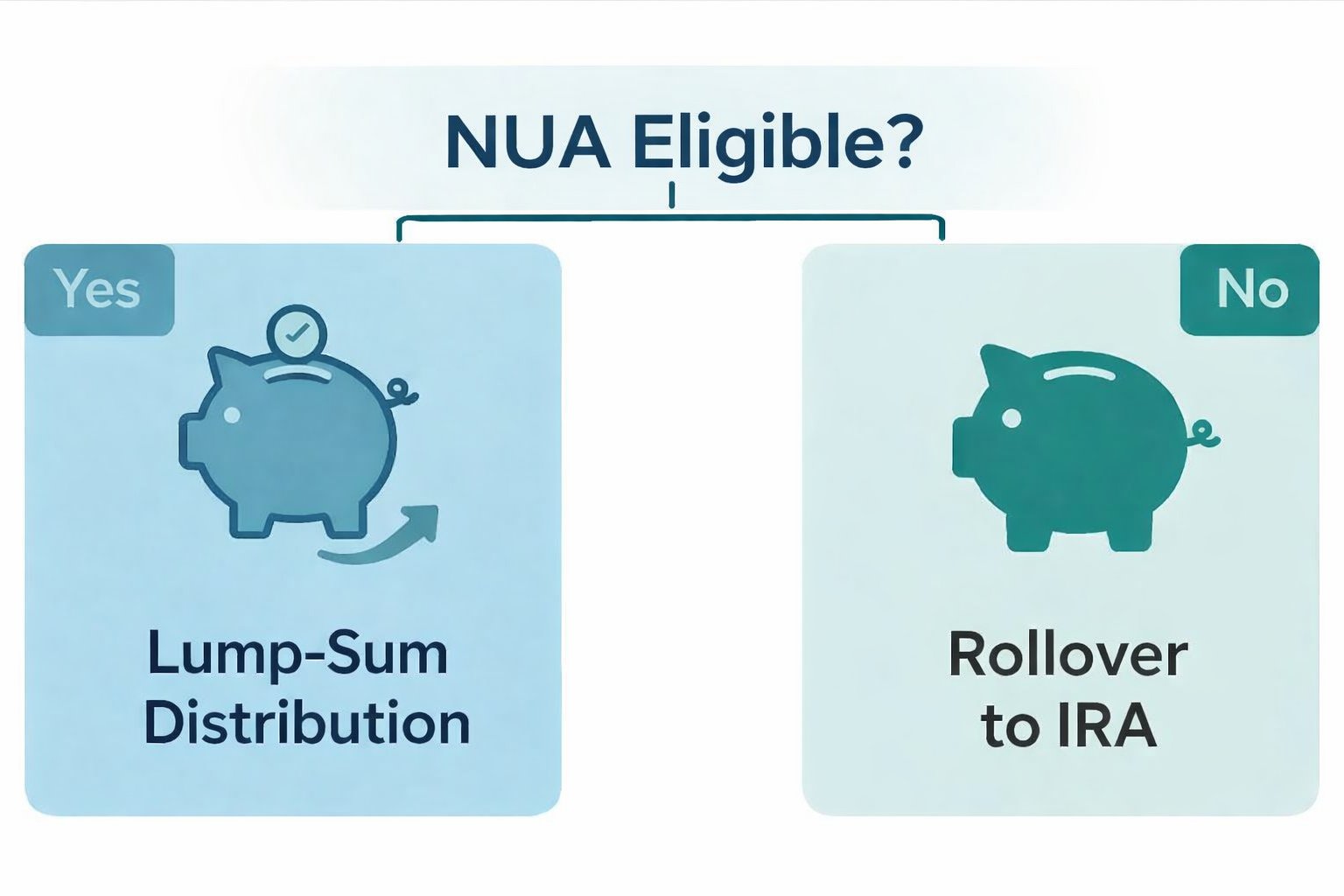

Eligibility Requirements

To qualify for NUA treatment, several IRS requirements must be met.

Common Conditions Include

Employer stock must be held in a qualified retirement plan

A lump-sum distribution of the entire plan balance must occur

The distribution must follow a triggering event, such as retirement, separation from service, disability, or reaching age 59½

Employer stock must be distributed in kind rather than liquidated

Failure to meet these requirements may disqualify the transaction from NUA treatment.

Lump-Sum Distribution Rules

A lump-sum distribution requires that all assets in the qualified plan be distributed within a single tax year. While employer stock may be distributed to a taxable brokerage account, other plan assets may be rolled into an IRA.

Coordinating this process requires careful planning to avoid unintended tax consequences.

Potential Planning Considerations

NUA strategies are often evaluated by individuals with significant employer stock concentration in retirement plans.

Common Factors Reviewed

Size of the NUA relative to overall plan value

Current and expected future tax brackets

Liquidity needs and timing of potential stock sales

Concentration risk associated with holding employer stock

Interaction with estate planning and charitable strategies

NUA is not universally beneficial and should be analyzed alongside alternative rollover options.

Risks and Limitations

While NUA may offer tax advantages in certain scenarios, it also introduces additional considerations.

Key Limitations

Loss of tax-deferred growth once stock is moved to a taxable account

Exposure to single-stock concentration risk

Complexity of IRS rules and documentation requirements

Potential impact on Medicare premiums or other income-based thresholds

These factors underscore the importance of coordinated planning.

Coordination With Professional Advisors

Because NUA involves retirement plan rules, tax law, and investment considerations, collaboration among financial, tax, and legal professionals is often essential.

Professional coordination may help ensure:

Eligibility requirements are met

Distribution timing is appropriate

Tax reporting is handled correctly

The strategy aligns with broader financial goals

Conclusion

The Net Unrealized Appreciation tax strategy is a specialized planning concept that may offer favorable tax treatment for certain employer stock distributions. Its effectiveness depends on meeting strict IRS requirements and aligning the strategy with overall financial objectives.

Careful evaluation and professional guidance are important when considering whether NUA treatment is appropriate.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investing involves risk, including possible loss of principal. The information presented is for educational purposes only and should not be interpreted as individualized investment, tax, or legal advice. Past performance is not indicative of future results. For more information, please review our Form ADV, available upon request.

Comments