A Guide to the Investment Decision-Making Process

- Feb 6

- 3 min read

Understanding the Investment Decision-Making Framework

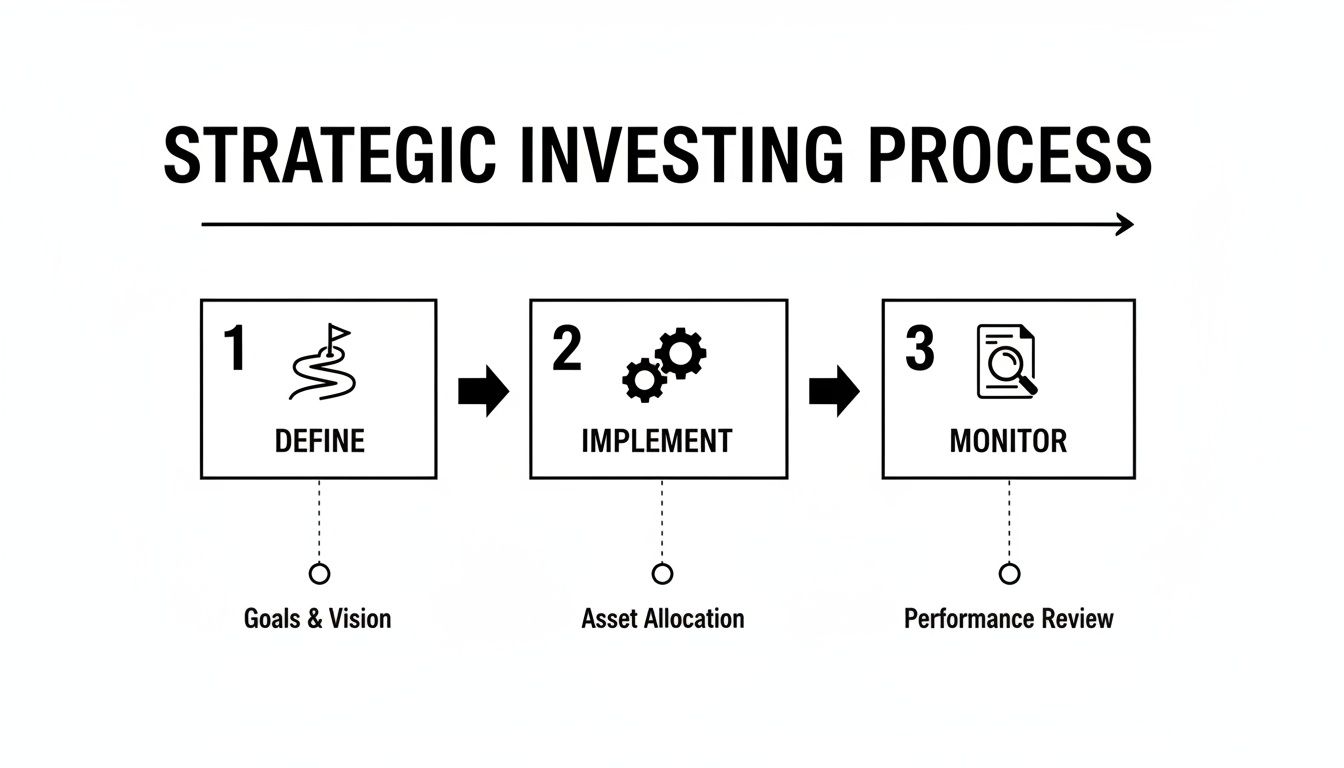

The investment decision-making process is a structured approach used to evaluate financial goals, assess risk, and determine how capital is allocated over time. Rather than relying on short-term market movements or speculation, this process emphasizes discipline, consistency, and alignment with long-term objectives.

This guide provides an educational overview of commonly used steps in investment decision-making and how they fit within a broader financial planning context.

Step 1: Defining Financial Goals

The foundation of investment decision-making begins with clearly defined financial goals. Goals may vary by time horizon, purpose, and priority.

Common Goal Categories

Retirement income planning

Education funding

Wealth preservation or growth

Charitable or legacy planning

Clarifying goals helps establish appropriate expectations and informs subsequent strategy decisions.

Step 2: Assessing Risk Tolerance and Risk Capacity

Risk tolerance reflects an individual’s comfort with market fluctuations, while risk capacity reflects the financial ability to absorb losses without compromising goals.

Understanding both elements helps determine an appropriate balance between growth-oriented and more conservative investments.

Step 3: Establishing an Asset Allocation Strategy

Asset allocation involves determining how capital is distributed across asset classes such as equities, fixed income, and cash.

Allocation decisions are often guided by:

Time horizon

Risk profile

Liquidity needs

Long-term objectives

Asset allocation is a key driver of portfolio behavior over time.

Step 4: Conducting Investment Research

Investment research involves evaluating potential investments using quantitative and qualitative analysis. This may include reviewing financial statements, understanding business models, and assessing broader economic conditions.

Research supports informed decision-making rather than reactive responses to market events.

Step 5: Implementing the Strategy

Once decisions are made, investments are implemented according to the established plan. Implementation considers factors such as account structure, tax implications, and cost efficiency.

Consistency in execution helps maintain alignment with strategic objectives.

Step 6: Monitoring and Reviewing the Portfolio

Ongoing monitoring is essential to ensure the portfolio remains aligned with goals and risk parameters.

Regular reviews often include:

Performance evaluation relative to objectives

Asset allocation drift analysis

Rebalancing considerations

Review of changing financial circumstances

Monitoring supports disciplined long-term management.

Step 7: Making Adjustments When Necessary

Adjustments may be appropriate following significant life events, changes in goals, or shifts in risk tolerance. Market volatility alone is not typically the sole driver of change.

Revisiting assumptions helps maintain relevance and alignment over time.

Behavioral Considerations in Decision-Making

Investor behavior can influence outcomes. Emotional reactions to market volatility may lead to decisions that conflict with long-term plans.

A structured decision-making process helps reduce behavioral bias by emphasizing predefined rules and long-term perspective.

Integrating the Process With Broader Planning

Investment decision-making does not occur in isolation. It is often coordinated with:

Tax planning

Retirement income strategy

Estate and legacy planning

Risk management and insurance

This integration supports cohesive financial planning.

Conclusion

The investment decision-making process provides a disciplined framework for aligning financial goals with portfolio strategy. By emphasizing structure, research, and ongoing review, individuals can approach investment decisions with greater clarity and consistency.

While no process eliminates uncertainty, a thoughtful and repeatable approach supports informed long-term planning.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investing involves risk, including possible loss of principal. The information presented is for educational purposes only and should not be interpreted as individualized investment, tax, or legal advice. Past performance is not indicative of future results. For more information, please review our Form ADV, available upon request.

Comments