A Guide to Risk Management in Investing

- Nov 4, 2025

- 3 min read

When it comes to investing, risk management isn’t about eliminating risk—it’s about making informed, strategic decisions to navigate uncertainty while working toward your long-term financial goals. Risk and reward often move hand in hand; understanding how to balance the two is at the heart of disciplined investing.

What Risk Management in Investing Really Means

An investment portfolio can be compared to a sailboat setting out across unpredictable seas. A seasoned captain doesn’t avoid the voyage because of possible storms—instead, they rely on maps, forecasts, and navigation tools to guide the journey.

Similarly, investors can use risk management principles to stay on course through the ups and downs of the market.

A strong risk management framework is proactive, not reactive. It’s about plotting a steady path rather than responding emotionally to market shifts.

The Two Primary Types of Investment Risk

To manage risk effectively, it helps to understand its main forms:

Systematic Risk This is broad-market risk—forces that impact nearly all investments. Examples include interest rate changes, inflation, political events, or economic recessions. Because it affects the entire market, it cannot be diversified away, but it can be managed through smart allocation.

Unsystematic Risk This is specific to a company or industry. For example, a disappointing earnings report or a product recall. Unlike systematic risk, unsystematic risk can often be reduced through diversification—by holding a range of assets across sectors.

A thoughtful investment plan should address both types, aiming to create resilience across various market conditions.

Assessing Your Personal Risk Profile

Every investor’s comfort with risk is shaped by both financial capacity (what they can afford to lose) and emotional tolerance (what they can handle mentally).Understanding both helps ensure your investment strategy is sustainable long-term.

Risk Capacity

Your financial ability to withstand losses without jeopardizing key goals like retirement or education funding.Key factors include:

Time horizon: Longer time frames allow recovery from downturns.

Income stability: Consistent income may allow for greater flexibility.

Savings base: A strong emergency fund increases your ability to handle volatility.

Risk Appetite (Tolerance)

Your psychological comfort with fluctuations in your portfolio’s value.

Two investors may have identical financials but react very differently to market dips. One may lose sleep over volatility; the other may see it as opportunity.

The goal is to find a balance you can stick with—because consistency is key.

Three Pillars of Managing Investment Risk

1. Diversification

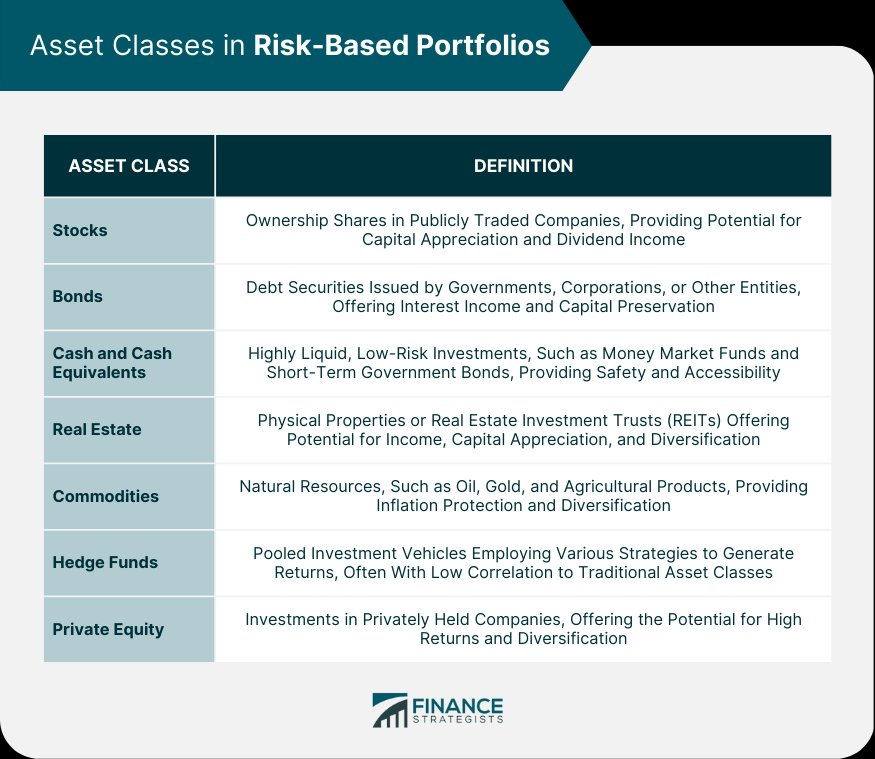

The principle of “not putting all your eggs in one basket.” A diversified portfolio blends different assets (stocks, bonds, real estate, etc.) across industries and regions to help stabilize returns.

2. Asset Allocation

Determining how much of each type of investment to hold. This strategic mix is influenced by your goals, timeline, and tolerance for risk.

A 30-year-old investor might lean heavily toward equities for growth opportunities, while a retiree may prefer bonds for income and capital preservation.

3. Rebalancing

Over time, portfolio weights shift as markets change. Regular rebalancing realigns your holdings to your original targets—essentially enforcing a disciplined “buy low, sell high” strategy.

Keep in mind potential tax implications when rebalancing, particularly in taxable accounts.

Economic Cycles and Market Behavior

Markets move in cycles of expansion and contraction, and recognizing this helps maintain perspective. During growth phases, optimism can push prices higher; during recessions, fear can drive short-term selloffs.Risk management is about building an all-weather portfolio—one that aims to endure both sunshine and storms.

Key insights:

Investor sentiment often swings from fear to greed—discipline counters both extremes.

Economic indicators (GDP, inflation, employment) can help inform, but not dictate, strategy.

Historical context reinforces that markets recover—patience rewards long-term investors.

Advanced Risk Management Techniques

For experienced investors, advanced tools can supplement the basics:

Hedging

Using instruments like options or futures to offset potential losses.Think of it as portfolio insurance—though, like insurance, it comes with a cost.

Alternative Investments

Assets such as real estate, private equity, or commodities can offer low correlation with traditional markets, adding another layer of diversification.

However, they require deeper due diligence and may involve liquidity constraints.

Emerging Markets

Adding exposure to developing economies can bring higher growth potential—but also higher volatility. Careful selection and awareness of currency and political risks are key.

The Ongoing Process of Risk Management

Risk management is not a one-time task—it’s a discipline. Regular reviews help ensure your strategy evolves with changes in your life, goals, and market conditions.

Building wealth is not about avoiding risk—it’s about understanding and managing it wisely to pursue long-term success.

To discuss how these strategies might apply to your specific situation, contact Parkview Partners Capital Management for a personalized consultation.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation.

There is no guarantee that tax-loss harvesting saves tax dollars.

Comments