A Guide to Retirement Planning in Columbus, Ohio

- Dec 11, 2025

- 3 min read

Building a Retirement Strategy With Local Awareness

Retirement planning involves aligning long-term goals with financial resources, lifestyle expectations, and evolving needs. For individuals and families in Columbus, Ohio, incorporating local cost-of-living factors, tax considerations, and demographic trends may provide additional context for building an effective plan.

This guide outlines several components that commonly appear in retirement planning. Each section offers general educational information to help frame the retirement planning process.

Establishing Retirement Goals

Clarifying retirement goals is an important starting point. A well-defined vision can help guide decisions about saving, investing, and future spending.

Consider:

Preferred lifestyle and level of activity

Travel or hobby plans

Anticipated housing needs

Timing of retirement and transition plans

Legacy or philanthropic intentions

Regularly updating these goals may help maintain alignment as circumstances change.

Understanding Income Needs and Cost of Living

Estimating future income needs involves analyzing expected expenses and assessing how they may change over time. In Columbus, factors such as housing costs, property taxes, healthcare resources, and local amenities may influence long-term planning.

Key Expense Categories

Housing (mortgage or rent, property taxes, utilities, maintenance)

Healthcare (Medicare premiums, supplemental coverage, out-of-pocket costs)

Transportation (vehicle expenses or public transit)

Daily living (food, entertainment, personal expenses)

Contingency and unexpected expenses

Developing a realistic expense estimate may provide clarity around required savings and income sources.

Saving and Investing for Retirement

A retirement strategy often includes a combination of employer-sponsored plans, individual retirement accounts, and taxable savings. These accounts may offer different tax treatments and withdrawal rules.

Common Considerations

Contribution rates to workplace retirement plans

Use of tax-deferred and tax-free accounts

Portfolio allocation based on timeline and risk tolerance

Ongoing diversification across asset classes

A diversified and regularly reviewed investment plan can help support long-term objectives.

Withdrawal Planning and Tax Awareness

Understanding how to withdraw assets in a tax-efficient manner may help preserve savings. This is especially relevant for retirees drawing from multiple account types.

Considerations

Order of withdrawals from taxable, tax-deferred, and Roth accounts

Timing of required minimum distributions (RMDs)

Interaction between income levels and Medicare premiums

Coordination with broader estate planning goals

A withdrawal plan that aligns with both financial and tax considerations may support sustainability of retirement savings.

Healthcare and Long-Term Care Planning

Healthcare needs often change with age, making advanced planning an important part of retirement preparation.

Topics to Review

Medicare enrollment and supplemental insurance options

Projected healthcare expenses

Potential long-term care needs and coverage

Resources available in the Columbus area

Integrating healthcare planning into the broader strategy can help maintain stability during retirement.

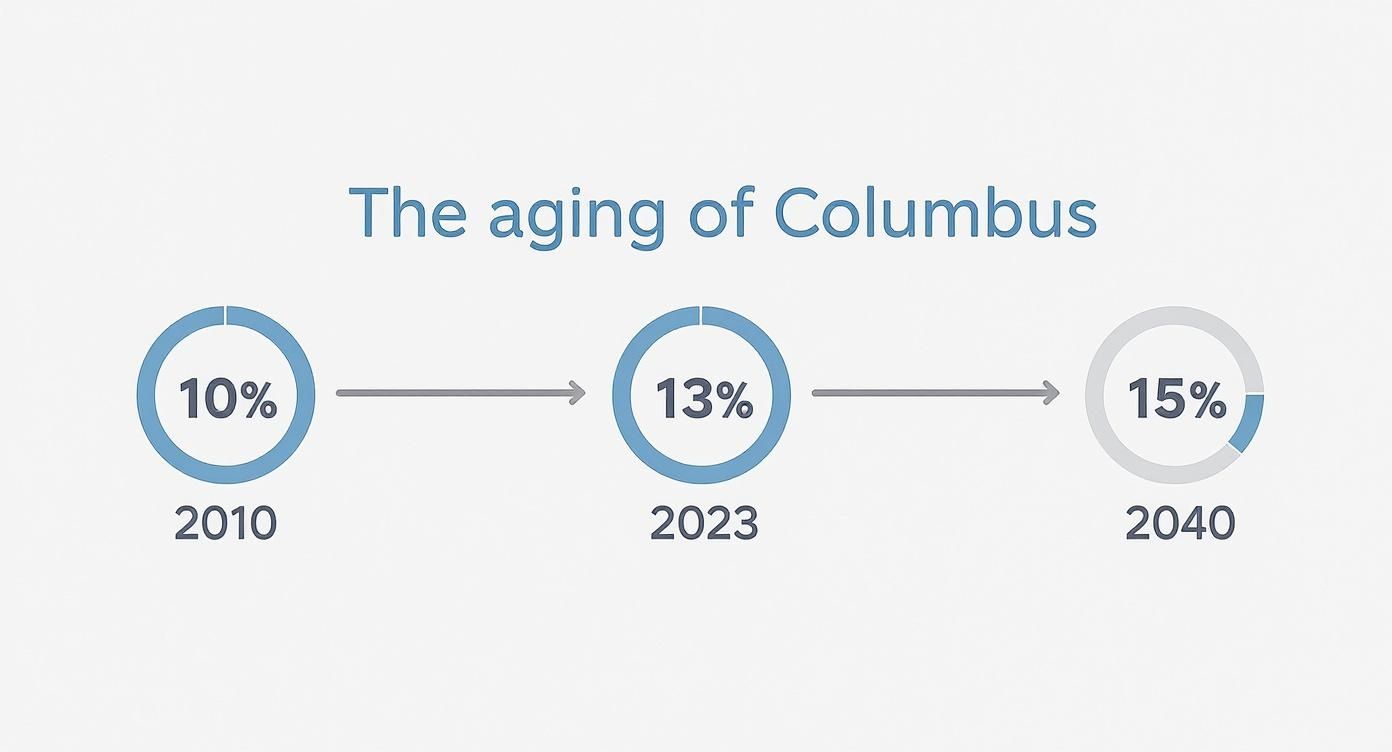

Understanding the Local Demographic Trends

Demographic trends in Central Ohio may offer context for planning. Columbus has experienced steady population growth, including a rising number of residents over age 65. These shifts may influence factors such as demand for healthcare services, housing, and community resources.

Awareness of these trends can help shape expectations and long-term decisions.

Reviewing and Updating the Plan

Retirement planning is an ongoing process. Regular reviews provide an opportunity to reflect changes in personal circumstances, market conditions, and tax laws.

Typical Review Topics

Progress toward retirement savings goals

Updated cash flow needs

Changes in risk tolerance

Life events such as relocation, inheritance, or career changes

Updating a financial plan periodically may help ensure alignment with long-term objectives.

Conclusion

Retirement planning in Columbus, Ohio, benefits from a thoughtful evaluation of financial needs, lifestyle expectations, and local considerations. By clarifying goals, organizing savings, understanding expenses, and reviewing plans regularly, individuals may be better prepared for a confident transition into retirement.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investing involves risk, including possible loss of principal. The information presented is for educational purposes only and should not be interpreted as individualized investment, tax, or legal advice. Past performance is not indicative of future results. For more information, please review our Form ADV, available upon request.

Comments