A Guide to Retirement Planning for Business Owners

- Sep 3, 2025

- 3 min read

Updated: Sep 16, 2025

Running a business often means wearing many hats—visionary, problem-solver, strategist, and leader. But one role that is sometimes overlooked is personal financial planner, especially when it comes to retirement. Unlike employees with employer-sponsored retirement plans, business owners need to be proactive in creating and managing their own retirement strategies.

This guide outlines key steps business owners can take to secure financial independence in retirement.

Separate Business and Personal Finances

Many business owners blur the line between business and personal accounts. While understandable in the early years of building a company, it’s important to establish clear separation. Keeping finances distinct not only simplifies tax reporting but also ensures that personal retirement savings are not overly dependent on the future of the business.

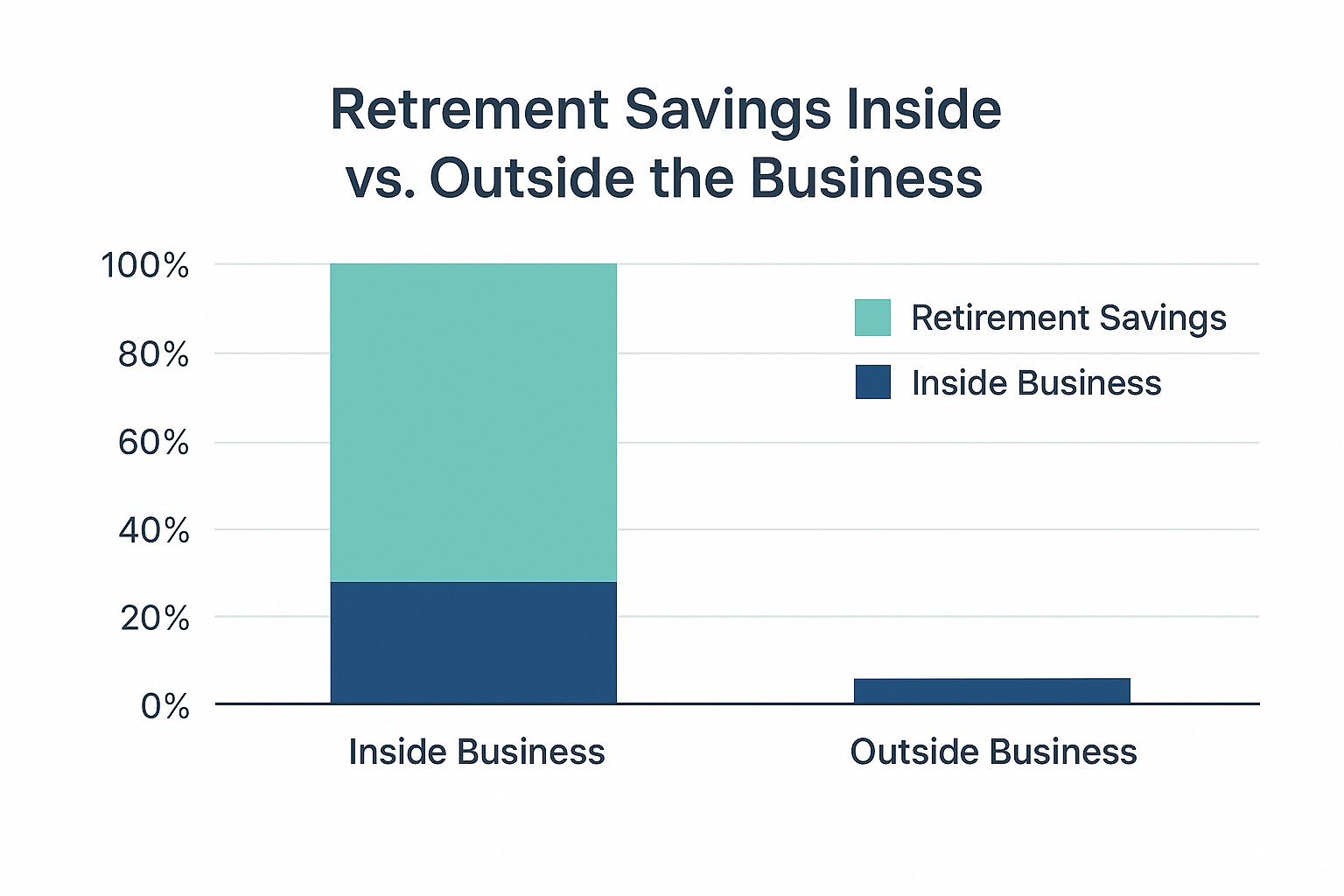

Diversify Retirement Savings Beyond the Business

It’s common for owners to consider their business itself as their primary retirement plan. While selling the business may one day provide a significant nest egg, it should not be the only source of retirement income. Markets, buyers, and valuations fluctuate. Creating diversified retirement accounts—such as IRAs, 401(k)s, or SEP IRAs—can help spread risk and create additional income streams.

Evaluate Tax-Advantaged Strategies

Business owners have unique opportunities for retirement planning. Options such as solo 401(k)s, SIMPLE IRAs, or defined benefit pension plans may allow larger contributions and potential tax deductions. Working with an advisor ensures that you’re choosing the right plan for your cash flow and long-term goals.

Build a Succession or Exit Plan

A strong succession plan not only provides confidence for the owner but also strengthens the business in the eyes of employees, customers, and potential buyers. Think through:

Who will run the business in your absence?

Will ownership transfer to family, employees, or an outside buyer?

What steps can you take today to make the business more attractive to future buyers?

Plan for Healthcare and Insurance Needs

Unlike employees who often retire with employer-sponsored health insurance, business owners must plan independently. Consider health savings accounts (HSAs), long-term care coverage, and life insurance policies as part of your retirement framework.

Partner with Professionals

Even the most successful entrepreneurs benefit from guidance. A retirement planning advisor can help align your business strategy with your personal financial goals, ensuring a smooth transition into retirement.

Plan Type | Ideal For | Contribution Flexibility | Maximum Contribution Potential |

SEP IRA | Sole proprietors or small businesses with few (or no) employees. | High. Contributions can be adjusted or skipped each year. | High. Up to 25% of compensation, maxing out at $69,000 (2024). |

SIMPLE IRA | Small businesses (up to 100 employees) looking for an easy-to-manage plan. | Lower. Requires mandatory employer contributions. | Moderate. Lower limits compared to a 401(k) or SEP. |

Solo 401(k) | Owner-only businesses (and a spouse). A powerful option for the self-employed. | High. You can contribute as both "employee" and "employer." | Very High. Often allows for the largest contributions for solo entrepreneurs. |

Defined Benefit Plan | High-earning owners (often 50+) who are behind on retirement and need to save aggressively. | Low. Contributions are calculated by an actuary to meet a future pension goal. | Extremely High. Can allow for six-figure tax-deductible contributions annually. |

Disclosures

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd. and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Past performance is not a guarantee of future results. To discuss how these strategies might apply to your specific situation, contact Parkview Partners Capital Management for a personalized consultation by visiting us at https://www.parkviewpcm.com.

Comments