A Guide to Mutual Fund vs ETF vs Individual Stock Costs

- Oct 28, 2025

- 3 min read

Understanding the true cost of investing is essential to long-term success. While mutual funds, exchange-traded funds (ETFs), and individual stocks can all provide growth opportunities, they come with different expense structures.

Mutual funds bundle management and administrative costs into a single expense ratio. ETFs combine low management fees with small trading costs. Individual stocks typically involve only transaction-based expenses but may require more hands-on management.

Choosing the right investment vehicle depends on your goals, trading habits, and desired level of control.

Understanding Core Investment Costs

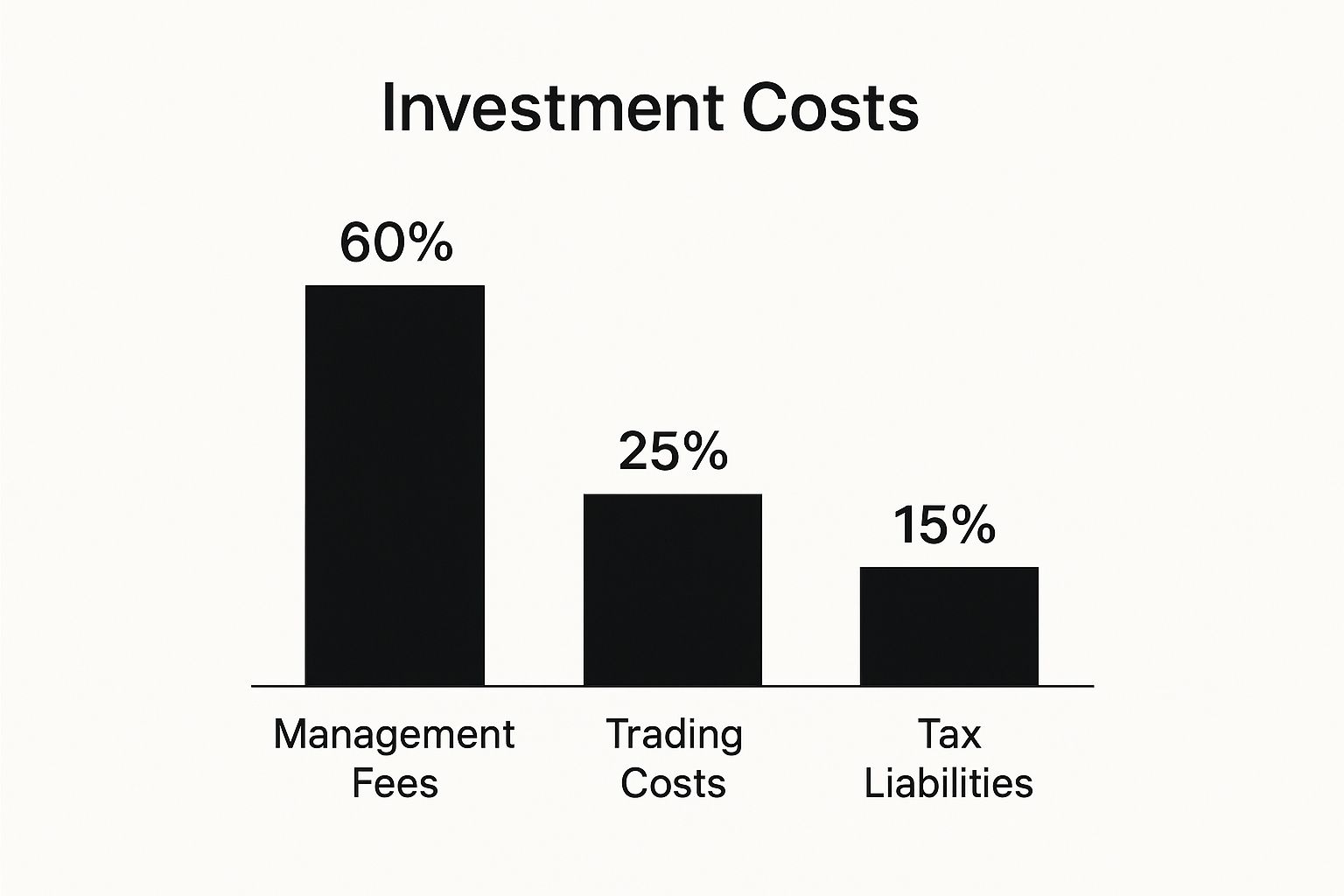

Every investment carries some combination of management fees, trading costs, and tax liabilities:

Management Fees: The ongoing costs for professional oversight, research, and administration in funds and ETFs.

Trading Costs: Commissions, bid-ask spreads, or fees associated with buying and selling securities.

Tax Liabilities: Taxes on capital gains or distributions, which differ between investment types and accounts.

These costs, while often small in percentage terms, can have a compounding effect over time—making cost awareness a cornerstone of portfolio strategy.

Management and Operating Fees

The expense ratio is a key metric for comparing funds. It represents the annual cost of managing a fund as a percentage of assets.

Mutual Funds

Actively managed mutual funds often seek to outperform a benchmark index. This hands-on management can increase costs—typically 0.50% to 1.00% or more per year. These higher fees may impact net returns, especially over long time horizons.

ETFs

Most ETFs are passively managed, aiming to mirror an index rather than beat it. This results in significantly lower expense ratios—often 0.03% to 0.25% annually. The structure of ETFs also helps reduce administrative overhead and improve cost efficiency.

Individual Stocks

Individual stocks have no expense ratio, but that doesn’t mean they’re cost-free. Investors may pay indirectly through:

Research subscriptions or data platforms

Advisory or management fees

The personal time spent managing the portfolio

While owning stocks directly provides full control, it also places all responsibility for diversification, trading, and monitoring on the investor.

Transaction Costs and Trading Impact

Beyond annual fees, transaction costs can meaningfully affect investment performance—particularly for active traders.

Mutual Funds

Mutual funds typically trade once per day at their Net Asset Value (NAV). Investors may incur:

Front-end loads (sales charges when buying)

Back-end loads (redemption fees when selling)

Level loads (ongoing sales commissions included in 12b-1 fees)

ETFs and Individual Stocks

ETFs and stocks trade throughout the day on exchanges, creating flexibility but also exposure to trading costs:

Commissions: Most brokers now offer zero-commission trading, but other fees may apply.

Bid-Ask Spread: The difference between buy and sell prices represents an implicit cost—small but impactful for frequent traders.

Market Orders vs. Limit Orders: Using limit orders can help manage transaction prices more effectively.

The Role of Tax Efficiency

Taxes can have as much impact on returns as fees do. Understanding how different investments generate taxable events is key.

Mutual Funds

Actively managed mutual funds often realize capital gains throughout the year, which must be distributed to shareholders—creating taxable income even if no shares are sold. This can lead to unplanned tax exposure.

ETFs

ETFs may be more tax efficient due to their “in-kind creation and redemption process.” Large investors exchange securities directly with the fund, allowing the ETF to remove low-cost-basis holdings without selling them. This can help mitigate some capital gains distributions.

Individual Stocks

Owning individual stocks provides full control over when gains are realized. Investors can sell strategically to manage tax outcomes, or use tax-loss harvesting to offset other gains.

Choosing the Right Fit for Your Portfolio

Each vehicle offers unique benefits depending on your goals and preferences:

Key Takeaway: There is no single “best” option—only the best fit for your financial goals, investment timeline, and comfort level with risk and management responsibilities.

Final Thoughts

A disciplined approach to investing includes analyzing both visible and hidden costs. Expense ratios, transaction fees, and taxes all play a role in shaping long-term performance.

Understanding the distinctions between mutual funds, ETFs, and individual stocks can help you choose investments that align with your financial plan and help mitigate unnecessary expenses.

Working with a fiduciary financial advisor can provide additional clarity and help ensure your portfolio remains cost-efficient, tax-aware, and aligned with your long-term goals.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation.

There is no guarantee that tax-loss harvesting saves tax dollars.

Comments