A Guide to Investment Strategy for Executives

- Oct 23, 2025

- 4 min read

An investment strategy for executives is fundamentally different from a typical financial plan. It must account for a unique financial landscape where personal wealth is often intertwined with corporate success through concentrated stock positions, deferred compensation plans, and complex tax considerations. A generic approach isn’t enough.

The right strategy can serve as a framework that aligns professional milestones with personal financial goals — balancing growth, tax efficiency, and legacy planning.

Crafting a Purpose-Driven Investment Strategy for Executives

The financial life of an executive includes many moving parts — salary, bonuses, stock options, and other incentives — all requiring a strategy as multi-layered as the compensation itself.

This guide offers a practical roadmap for aiming to convert career success into lasting wealth. The goal is to create a resilient plan that adapts to evolving career stages and family priorities.

Unique Financial Considerations for Leaders

Executives face distinct challenges when managing wealth and compensation. Understanding these nuances is the first step toward long-term financial stability and tax efficiency.

Implementation Considerations:

Concentrated Equity: Large company stock holdings can create overexposure and tie personal wealth to corporate performance.

Complex Compensation: Navigating ISOs, NSOs, RSUs, and deferred compensation requires coordination and timing to manage tax impact.

Trading Restrictions: As a corporate insider, trading windows and compliance rules must be observed carefully.

A strong investment strategy should remain flexible — adapting to promotions, new equity grants, and family transitions while staying aligned with your overall financial vision.

Aligning Investments With Career and Life Goals

For executives, investing isn’t just about numbers — it’s about creating a financial engine that supports career ambitions and family goals. Whether launching a second career, starting a foundation, or leaving a generational legacy, a well-built strategy can help ensure your wealth keeps pace with your evolving life.

Translating Life Goals into Financial Targets

Turning broad ambitions into measurable goals brings clarity and focus. For example, estimating startup costs for a consulting venture or calculating future college expenses helps translate dreams into actionable targets.

Implementation Considerations:

Tier Your Goals: Separate needs (retirement), wants (vacation home), and wishes (philanthropic goals) for better capital allocation.

Create a “Work-Optional” Window: Replace rigid retirement dates with flexible timelines to navigate market shifts or life changes.

Plan for Liquidity Events: Strategically allocate proceeds from stock vesting or company sales before they occur to avoid impulsive decisions.

Advanced Tax Efficient Strategies

For executives, compensation often spans salary, bonuses, and equity — each with unique tax implications. An effective plan integrates year-round tax strategy, which aims to help reduce surprise liabilities and potentially maximize after-tax returns.

The key is being proactive — timing option exercises, equity sales, and deferred compensation distributions deliberately rather than reactively.

Navigating Equity Compensation Tax Rules

Stock-based compensation is powerful, but tax timing matters. Incentive Stock Options (ISOs), Non-Qualified Stock Options (NSOs), and RSUs are taxed differently, and poor timing can significantly increase liabilities.

Implementation Considerations:

Model Scenarios: Run simulations to test different exercise and sale dates — even splitting activity across tax years may save thousands.

Assess Big Picture Impact: Consider how a large equity gain might affect deductions and credits.

Plan NQDC Distributions Early: Payout schedules often lock years in advance — plan them to coincide with future income needs.

Annual Tax Check-In: Review compensation annually to align with changing tax laws and financial goals.

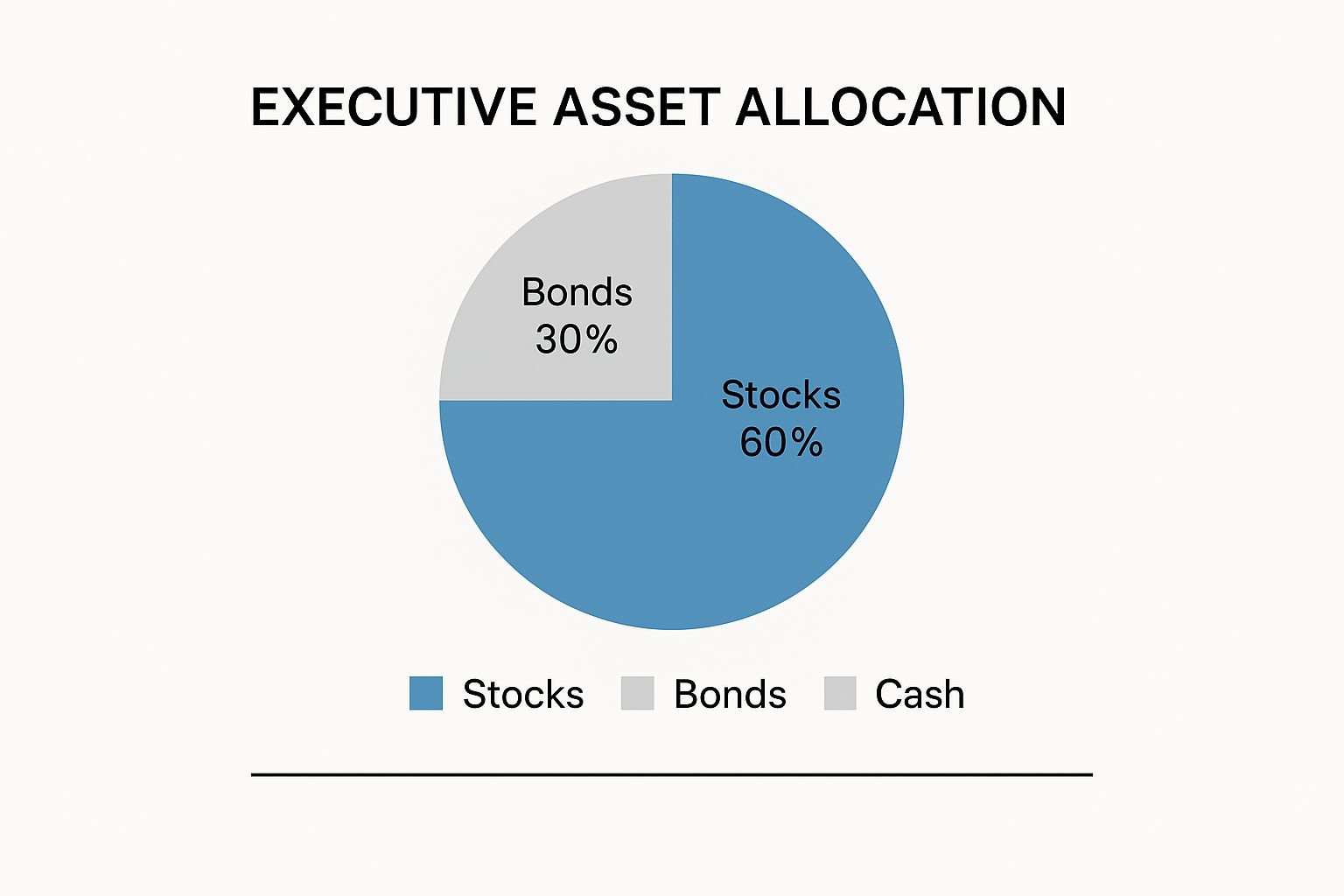

Diversifying Beyond Concentrated Company Stock

Many executives hold significant portions of wealth in company stock. While this shows commitment, it creates concentration risk — your financial success may rise or fall with your employer’s.

A structured diversification strategy helps balance returns and risk.

Implementation Considerations:

Use Rule 10b5-1 Plans: Schedule pre-arranged stock sales to comply with insider trading rules and remove emotion from timing decisions.

Automate the Process: Pre-set sales help prevent reactive decisions during market swings.

Maintain Control: Define sale thresholds and timing to meet diversification and tax objectives.

Consider Donor-Advised Funds (DAFs): Donating appreciated stock can reduce taxable income and fund charitable goals.

Integrating Estate Planning and Legacy Goals

A complete investment strategy extends beyond wealth accumulation — it includes legacy planning. Estate planning aims to ensure your assets are transferred efficiently and aligned with your values.

Core Estate Documents:

Last Will and Testament: Defines how assets are distributed.

Trusts: A revocable living trust can streamline transfers and bypass probate.

Powers of Attorney: Designate trusted individuals for financial and healthcare decisions if you become unable to act.

For larger estates, strategies like Grantor Retained Annuity Trusts (GRATs) and Irrevocable Life Insurance Trusts (ILITs) can help mitigate estate taxes and provide heirs with liquidity without forcing asset sales.

Conclusion: A Blueprint for Financial Leadership

Creating an effective investment strategy is not a one-time event — it’s an evolving plan that grows alongside your career. From aligning personal goals to managing taxes, diversification, and legacy planning, every element works together to support lasting financial security.

Your financial picture is unique — shaped by your compensation, ambitions, and risk tolerance. The goal isn’t just to react to markets, but to proactively design a strategy that funds your ambitions and provides long-term confidence.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd. and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Please consult with your professional advisors before taking any action. Past performance is not a guarantee of future results.

Comments