A Guide to Comprehensive Financial Planning

- Oct 31, 2025

- 2 min read

Financial planning is about aligning your resources with your life’s priorities—not chasing the latest market trend. At Parkview Partners Capital Management, we view comprehensive planning as an ongoing process that adapts as your circumstances and goals evolve.

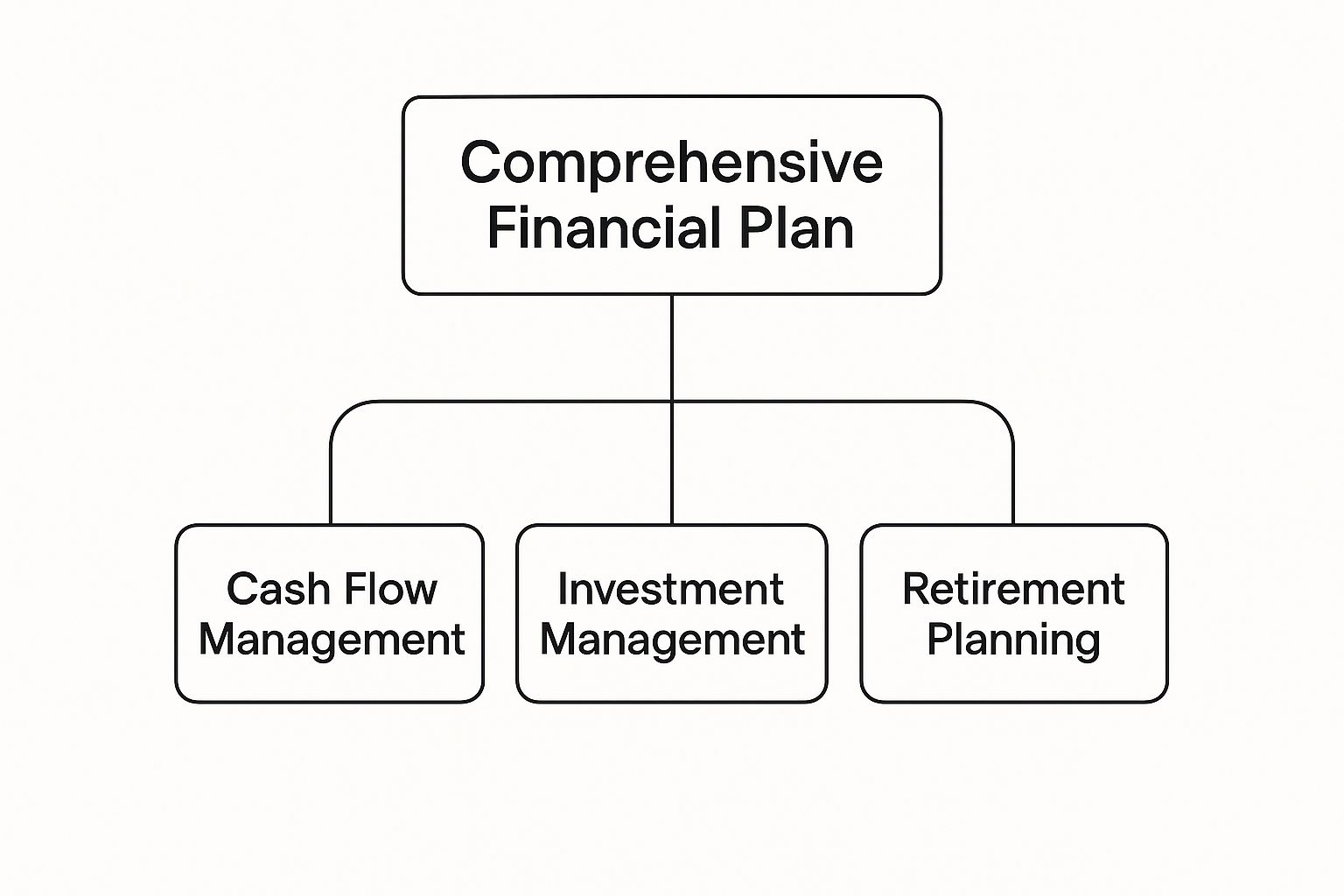

1. Understanding What "Comprehensive" Means

A comprehensive plan looks beyond investments. It coordinates cash-flow management, tax awareness, risk management, estate considerations, retirement income, and charitable intent. The objective is to create a framework that supports your lifestyle and family priorities through changing market and personal conditions.

2. Starting With a Clear Picture

Effective planning begins with a full understanding of where you are today:

Income and expenses

Current savings, investments, and debt

Insurance coverage and employer benefits

Short- and long-term goals

With that information, your advisor can help outline realistic steps and strategies tailored to your situation.

3. Investment Strategy in Context

Investments are one component of a broader plan. The focus should remain on aligning your portfolio with your objectives, time horizon, and comfort with risk—not on predicting markets. A diversified approach, regularly reviewed and adjusted, helps maintain discipline through different market cycles.

4. Managing Risk and Protection

A comprehensive plan also evaluates the unexpected. Life insurance, disability coverage, and long-term-care solutions can help provide safeguards for the people and assets you care about. The right coverage amounts and types depend on individual goals, age, and financial obligations.

5. Planning for Retirement

Retirement planning involves more than accumulating assets; it’s about developing income strategies, considering tax efficiency, and determining sustainable withdrawal approaches. Evaluating Social Security timing, employer plans, and health-care costs can help provide clarity and confidence in transition.

6. Estate and Legacy Considerations

Thoughtful estate planning ensures assets are distributed according to your wishes while helping minimize administrative complexity. A coordinated plan may include wills, trusts, powers of attorney, and beneficiary designations that align with your financial strategy.

7. Ongoing Review and Collaboration

Financial planning is not a one-time event. Regular reviews help ensure your plan evolves with life events such as job changes, new family members, or shifts in the economy. Collaboration among your financial, tax, and legal professionals keeps each element working in concert.

8. Taking the First Step

Wherever you are in your financial journey, starting—or revisiting—a comprehensive plan can bring clarity and organization to your decision-making. An experienced advisor can help you understand your options and create a path that fits your goals and comfort level.

The information presented is for educational purposes only and should not be interpreted as specific investment, legal, or tax advice. Individual situations vary, and readers should consult the appropriate professionals regarding their unique circumstances.

Investment advisory services are offered through Stratos Wealth Partners, Ltd., a registered investment adviser. Stratos Wealth Partners and Parkview Partners Capital Management are separate entities.

Comments