A Guide to Central Ohio Business and Real Estate Trends for Investors

- Dec 23, 2025

- 3 min read

Understanding Central Ohio's Economic Environment

Central Ohio has experienced meaningful economic activity in recent years, supported by growth in technology, logistics, advanced manufacturing, and population migration into the region. For investors, understanding these local trends may help provide context for long-term planning, diversification decisions, and real estate–related considerations.

This guide offers an educational overview of the regional landscape and summarizes commonly used resources for tracking business and real estate developments.

Key Drivers Of Regional Growth

Several structural trends influence the business and real estate climate in Central Ohio:

Technology and Advanced Manufacturing

Investments from national and global companies have supported the region’s emergence as a center for high-tech manufacturing and data-driven industries.

Logistics and Distribution

Central Ohio’s geographic position has made it a significant hub for e-commerce fulfillment and supply-chain operations, contributing to demand for industrial real estate.

Population and Workforce Growth

A growing workforce may influence residential demand, economic activity, and development across multiple commercial sectors.

Monitoring these factors can help frame expectations about the area's economic direction.

Residential Real Estate Dynamics

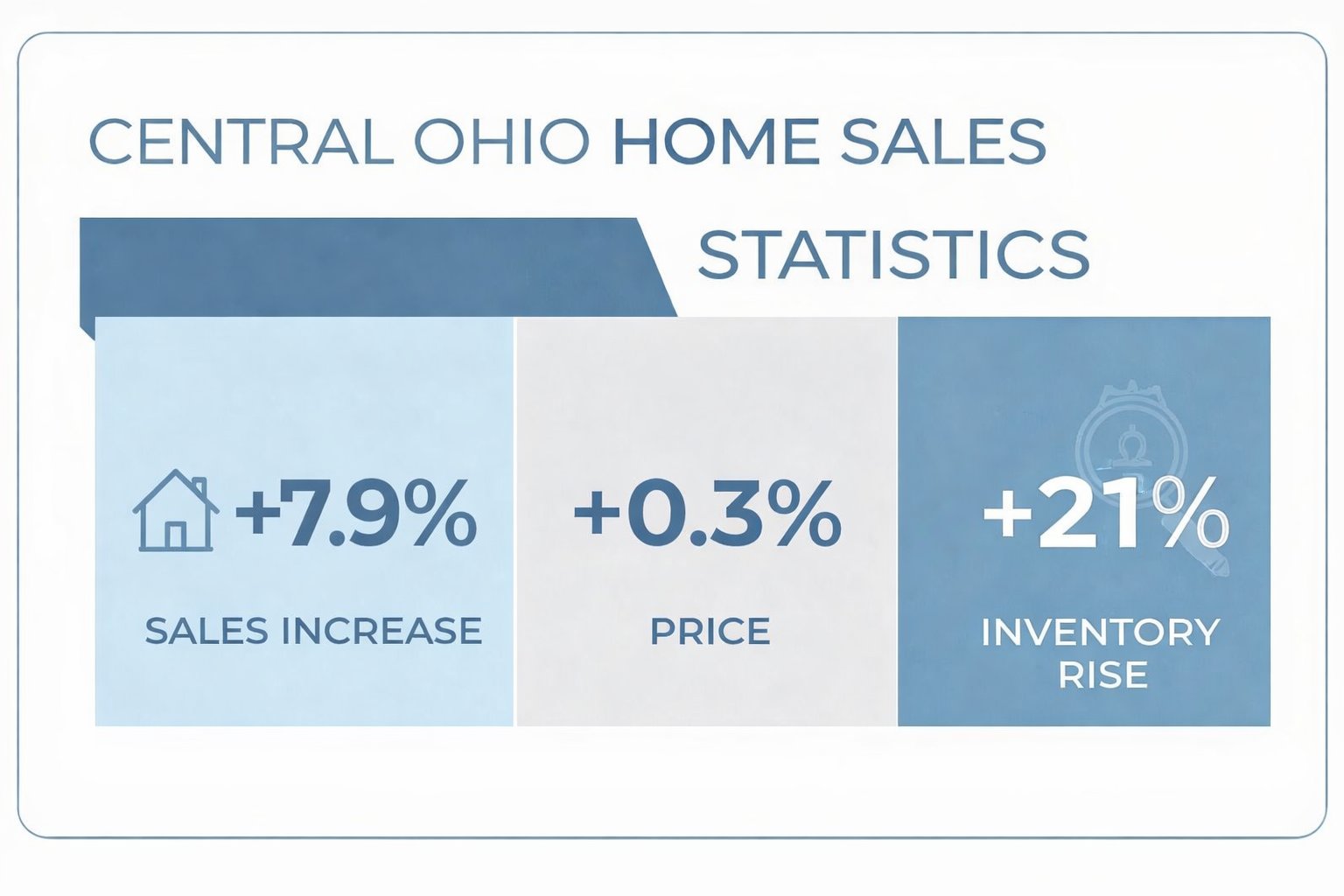

Residential activity often reflects broader economic health. Recent data illustrates an active local market with rising sales volume and expanding inventory.

Source: WSYX, https://abc6onyourside.com/news/local/central-ohio-home-sales-september-2025-columbus-realtors-market-report-real-estate-housing-inventory-prices-franklin-licking-union-county-mls-buyers-sellers-negotiation-homes-condominiums-trends-data-analysis; Columbus Realtors, https://columbusrealtors.com/news/2025/11/20/1homepage/central-ohio-housing-report-october-2025/

Common Indicators Reviewed

Home sales volume

Median sale prices

Inventory levels and new listings

Median days on market

List-to-sale price ratios

These metrics help contextualize supply, demand, and pricing stability.

Why These Metrics Matter

Understanding market velocity—how quickly homes sell and how closely sale prices align with listings—can support informed planning around timing, liquidity needs, or real estate–related strategies.

Evaluating Market Health Through Key Performance Metrics

Market indicators offer insights into the balance between buyers and sellers. Trends such as rising inventory, stable prices, or moderate shifts in days on market can highlight changes in sentiment or local economic momentum.

Examples of commonly referenced KPIs include:

Rate of new property listings

Months of supply

Sale-to-list price ratios

Changes in mortgage-rate environments

These figures may help investors gauge how broader conditions could influence housing demand, borrowing considerations, or real estate–linked investments.

Notable Commercial Sectors Themes

Commercial real estate in Central Ohio is influenced by several fast-evolving industries:

Industrial and Logistics

Demand for warehouse and distribution space remains closely tied to e-commerce and supply-chain trends.

Technology and Data Infrastructure

Data centers, semiconductor facilities, and research-related construction may support long-term commercial expansion needs.

Healthcare and Life Sciences

Growth in healthcare services and medical research may influence demand for medical office buildings and regional facilities.

Advanced Manufacturing

Production facilities with specialized configurations may see increased activity as companies modernize supply chains.

Understanding sector-specific dynamics may help identify where demand is concentrated.

Local Resources for Staying Informed

Investors often reference regional data sources to follow Central Ohio business and real estate developments.

Economic Development Organizations

One Columbus: Tracks corporate expansions and economic forecasts.

Mid-Ohio Regional Planning Commission (MORPC): Provides demographic, transportation, and long-term planning insights.

Real Estate and Business Publications

Columbus REALTORS®: Offers monthly residential market data.

Columbus Business First: Covers local business activity, commercial real estate transactions, and industry news.

Regularly reviewing these sources can support a clearer understanding of regional trends.

Integrating Local Trends Into Broader Financial Planning

Local conditions can provide helpful context but should be evaluated within the framework of an individual’s broader financial strategy, risk tolerance, and long-term goals.

Areas of Consideration

Connections between local real estate and broader investment diversification

Liquidity needs that may be influenced by property market conditions

Potential opportunities or risks associated with sector growth

How regional data may inform planning conversations with professionals

Understanding the local environment can complement, rather than replace, a diversified long-term investment plan.

Conclusion

Central Ohio’s business and real estate trends reflect an evolving regional economy shaped by growth in technology, logistics, and advanced manufacturing. For investors, following these developments may provide meaningful context for long-term planning and decision-making. Using reliable local resources, maintaining awareness of market indicators, and integrating insights into a personalized wealth strategy can help support thoughtful, informed financial organization.

Investment advice offered through Stratos Wealth Partners, Ltd., a registered investment advisor. Stratos Wealth Partners, Ltd and Parkview Partners Capital Management are separate entities. Neither Stratos nor Parkview Partners Capital Management provides legal or tax advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investing involves risk, including possible loss of principal. The information presented is for educational purposes only and should not be interpreted as individualized investment, tax, or legal advice. Past performance is not indicative of future results. For more information, please review our Form ADV, available upon request.

Comments